My yesterday’-s post about the Obama–-Clinton prediction markets was the most popular Midas Oracle story of that Monday. Hummmm…- No idea why…- I was not helped by Google Search or by an external blogger. Sounds like our Midas Oracle web readers and feed subscribers liked it …- for some reasons I have yet to discover fully.

Anyway.

- I’-m minding a grand “-Midas Oracle Project“-, and you can join it.

- Emile believes that prediction markets represent “-the future of journalism“-. I am trying to mind, specifically, what form could take the “-prediction market journalism“-.

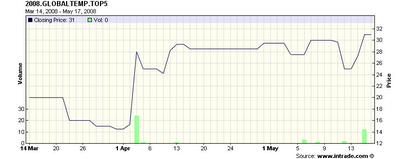

- The idea is this: We need to put the charts of prediction markets inside news stories, and those stories should incorporate the meaning of the probability fluctuations (a la Justin Wolfers).

- If we stay in our armchairs, nothing will happen, because most of the old-school journalists and bloggers don’-t think much of the prediction markets. The prediction market infiltration in the Mediasphere and the Blogosphere is like a weak stream, right now. I don’-t have the patience to wait until “-2020″-.

- I don’-t think that much will come out of the prediction exchanges. The BetFair blog and the InTrade newsletter are 2 pieces of crap —-they compete in content quality with the Mongolian edition of the News Of The World.

- If you look at the evolution of the media, you see that the old-school, dead-tree publications are slowly dying, and are replaced by professional blog networks —-look especially in the IT industry, with TechCrunch, etc. What you have is writers who publish only for the Web, and who fill a vertical niche. (And, the Washington Post is now publishing content from…- guess who.)

- Needless to say, prediction market journalism is costly. Now, go directly to point #8, because that’-s where the beef is.

- Yes, I have “-heard of Christmas”-

, and I understand Robin Hanson’-s reasoning. [*] That’-s where my funding idea lays. The idea is to think hard about who “-might actually be willing to pay”-. I am thinking of a class or organizations that “-might actually be willing to pay”-, provided 2 things. Number one, that I operate a certain twist on my form of prediction market journalism. Number two, that this project becomes the project of many prediction market people, or, better, of the whole prediction market industry —-not just Chris Masse’-s one. Those 2 things are essential.

, and I understand Robin Hanson’-s reasoning. [*] That’-s where my funding idea lays. The idea is to think hard about who “-might actually be willing to pay”-. I am thinking of a class or organizations that “-might actually be willing to pay”-, provided 2 things. Number one, that I operate a certain twist on my form of prediction market journalism. Number two, that this project becomes the project of many prediction market people, or, better, of the whole prediction market industry —-not just Chris Masse’-s one. Those 2 things are essential. - So, Emile, wanna join the “-Midas Oracle Project“-?

–

[*] APPENDIX:

The “-high IQ”- Robin Hanson:

Chris, you’ve heard of Christmas I presume. Many people circulate lists of items they might like for Christmas. If you did, would you circulate a list of million franc/dollar gift ideas for people to give you? Would you consider that list more honest/logical than a list of gifts of roughly the price you think others might actually be willing to pay?

–