Tag Archives: Finance

Nassim Taleb says we will have soon another crisis that will make the current one looks like a picnic. – [VIDEO]

[Download this post to watch the embedded video above, if your feed reader does not show it to you.]

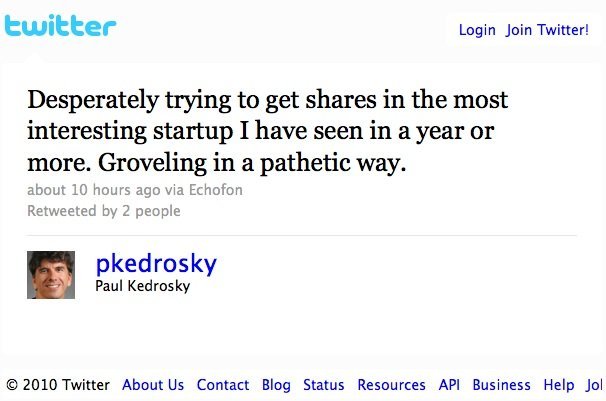

What does this tell you about the state of the startup capital market?

How much are startup options worth?

BetFair set a price range for its initial public offering on the London Stock Exchange at $17.48 to $22.25 a share, valuing its equity at up to $2.35 billion.

U.S. regulators unveiled a series of proposed governance rules for derivatives clearinghouses and trading platforms that are designed to protect the market.

Quants: The Alchemists of Wall Street

Sports Risk Index would allow you to hedge risks on sport prediction markets.

The latest developments. (audio)

I am skeptical, since the US Congress has just outlawed movie prediction markets, but I wish good luck to Chris Rabelais et al. Maybe the political scene will be different next year, who knows.

UPDATE: As you’-ve understood, I was talking about CFTC-approved real-money prediction markets, here.

Sports Risk Index would allow you to hedge risks on sport prediction markets.

The patent.

The latest developments. (audio)

I am skeptical, since the US Congress has just outlawed movie prediction markets, but I wish good luck to Chris Rabelais et al. Maybe the political scene will be different next year, who knows.

UPDATE: As you’ve understood, I was talking about CFTC-approved real-money prediction markets, here.