Category Archives: Finance

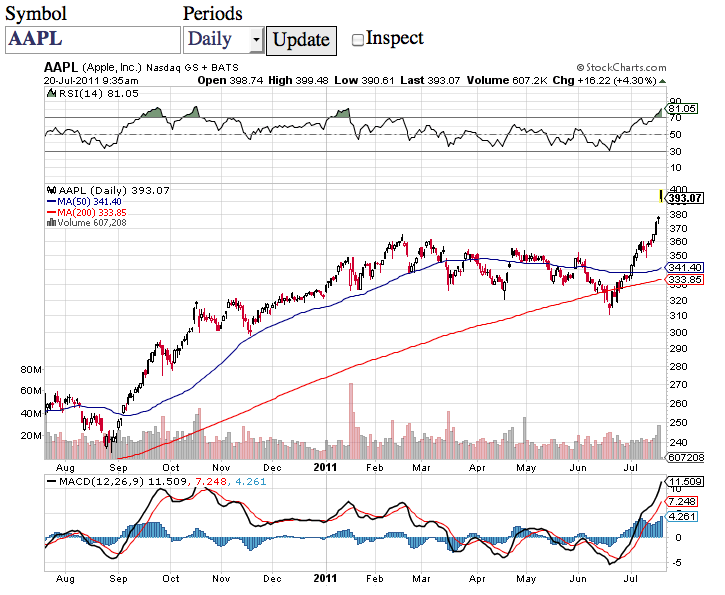

Apple stock today — [CHART]

Nassim Taleb says we will have soon another crisis that will make the current one looks like a picnic. – [VIDEO]

[Download this post to watch the embedded video above, if your feed reader does not show it to you.]

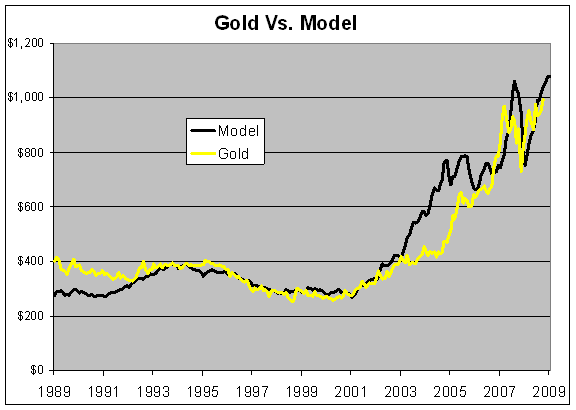

Mr T. is more bullish on gold than Mr Ruspini.

–

U.S. regulators unveiled a series of proposed governance rules for derivatives clearinghouses and trading platforms that are designed to protect the market.

Quants: The Alchemists of Wall Street

Jason Ruspini, vice president of Conquest Capital, reveals the three indicators he uses to predict how high gold prices will go.

Download this post to watch the video, if your feed reader does not show it to you.

Previously: The Interdependence of Prices and Gold –- by Jason Ruspini

UPDATE:

Jason:

I did not give $1500 as a gold target this year! When asked for my gold price prediction, I said, if you look at gold as a % of global fx reserves and investable assets you can justify very high gold price predictions, but I don’t like to model absolute levels, I like to look at marginal, incremental signals. If you put a gun to my head though: $1300-1350 — not “$1300-1500?.

Also edited out was a differentiation of liquidity shock vs. deflation vs. disinflation.

I should add that long-term trend-following is a fine way to trade gold.

These are all my own opinions, not those of Conquest.

HuffPost on derivatives (and prediction markets)

Jim Rogers on commodities, currencies, stocks, banks, emerging markets, etc.

![]()

InTrade co-founders brand-new newsletter on finance

![]()

If you would like to subscribe to the free Patrick Young weekly newsletter, follow this link.

I am now a subscriber. I am looking forward to reading his take on the financial crisis.