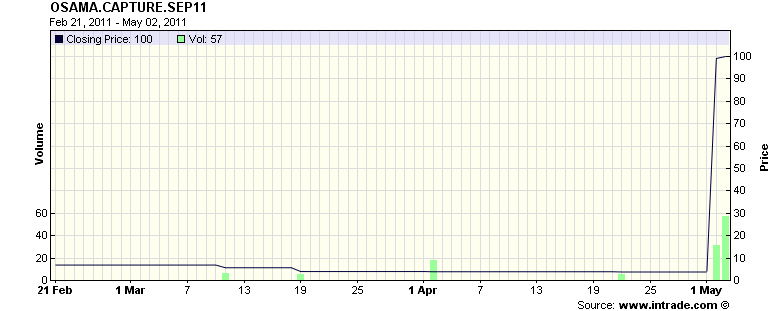

How do we know the Intrade price was not accurate? Well, the raid wasn’t just executed on a whim. It had been planned for quite some time. Therefore, the true likelihood must have been much higher than the four or five percent chance the market was telling us.

Many people knew of the plans, albeit they were very high ranking, sworn-to-secrecy types. Since the market did not reflect the potential success of the planned raid, either the market was inefficient or the market, in an aggregate sense, did not possess enough information to make a reasonably informed prediction. In this case, I have to believe the market participants (every last one of them) knew next to nothing about the outcome being predicted.

The Intrade market prediction was nothing more than an aggregation of guesses. This is very different from an accurate prediction (based on calibration) that turns out to be wrong.

Markets such as these have no use, whatsoever, in decision-making. The useful information was that gathered by the SEALs and other secret services, and that was the information provided to the real decision-maker, The President. I would argue that these types of markets have no place as betting markets either. There is no way to test the calibration, so we don’t know whether they are “fair” markets (unlike the accurate calibration of horse races and casino games).

In other words, stop wasting our time operating and analyzing these markets. They are never going to be useful.