![]()

Don’-t Short Obama

Why political futures markets got the health care bill so wrong.

By Daniel Gross

Posted Monday, March 22, 2010, at 6:05 PM ET

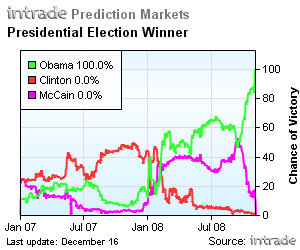

It would be very difficult to tote up all the times pundits pronounced the health care bill dead, and the prospects for the Obama administration dire—especially after the election of Scott Brown in January. Intrade, the political futures market, which functions as a conventional-wisdom-processing machine, also got health care wrong. Check out this chart for the contract on health care reform being passed by June 2010. The contract is worth 100 if it is passed, zero if it is not. After Brown’-s election, it slumped to as low as 20. As recently as March 17, it was below 40. Even as late as Friday, it was trading in the mid-80s. These trading data show that “-investors”- in this market were skeptical of the Obama administration’-s ability to pass significant health care legislation, right up until the end.

Is there a larger lesson here? (Aside from the obvious one, which is political futures markets usually aren’-t very good at predicting what actually will happen in the future?) I think so. And it’-s this: Don’-t short Obama. In fact, that’-s been the lesson of Obama’-s entire career so far.

[Stock market stuff inserted here.]

On some level, it’-s tough to blame the Intrade crowd for getting Obama and health care wrong. The type of people who trade there, folks who think they’-re quite savvy about money, the market, and politics, are the same conventional wisdom hawkers who were so monumentally wrong before the financial crisis. If you’-ve tuned into CNBC or Fox Business Channel, or read the Wall Street Journal since January 2009, you would have been subject to a constant stream of money managers, pundits, talking heads, and policy wonks declaring that the U.S. economy is becoming a socialist hellhole that is hostile to business and investors. (If there were a way to short Fox Business Channel, I’-d do it in a hurry.)

The conventional wisdom market has not yet internalized the message that it’-s dangerous to your financial and professional health to short Obama. Judging by the debate in the House last night, by the talk on cable news shows this morning (full of talk about how this is going to kill Democrats in November), and by the chatter on the business networks this morning (full of talk about how the tax increases in the health care bill will destroy the markets and the economy), the shorts haven’-t learned anything.

–

I agree with Dan Gross that prediction markets are a “-conventional-wisdom-processing machine”-. Prediction markets incorporate expectations (informed by facts and expertise) just like the mass media do.

Prediction markets can’-t look into the far away future.

In the ObamaCare case, prediction markets have just been summarizing objectively, dynamically and quantitatively (day in, day out) what the political media were reporting about the health care reform, and about the prospect of its passing in Congress and of its signing by the President.

It would be easy for a scientist to verify that —-by comparing archived media articles with the historical InTrade prices.

ADDENDUM: To answer Hutch’-s question, the only trouble I saw in the history of this contract is the brief manipulation that happened on March 16, 2010.

UPDATE: Funny video: