![]()

–

#1. Explainer On Prediction Markets

–

Prediction markets produce dynamic, objective probabilistic predictions on the outcomes of future events by aggregating disparate pieces of information that traders bring when they agree on prices. Prediction markets are meta forecasting tools that feed on the advanced indicators (i.e., the primary sources of information). Garbage in, garbage out…- Intelligence in, intelligence out…-

A prediction market is a market for a contract that yields payments based on the outcome of a partially uncertain future event, such as an election. A contract pays $100 only if candidate X wins the election, and $0 otherwise. When the market price of an X contract is $60, the prediction market believes that candidate X has a 60% chance of winning the election. The price of this event derivative can be interpreted as the objective probability of the future outcome (i.e., its most statistically accurate forecast). A 60% probability means that, in a series of events each with a 60% probability, then 6 times out of 10, the favored outcome will occur- and 4 times out of 10, the unfavored outcome will occur.

Each prediction exchange organizes its own set of real-money and/or play-money markets, using either a CDA or a MSR mechanism.

–

More Info:

– The Best Resources On Prediction Markets = The Best External Web Links + The Best Midas Oracle Posts

– Prediction Market Science

– The Midas Oracle Explainers On Prediction Markets

– All The Midas Oracle Explainers On Prediction Markets

–

–

#2. Objective Probabilistic Predictions = Charts Of Prediction Markets

–

Put your mouse on your selected chart, right-click, and open the link in another browser tab to get directed to the prediction market page of your favorite exchange.

–

–

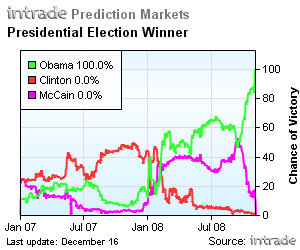

2008 US Elections

–

–

InTrade

–

2008 US Electoral College

2008 Electoral Map Prediction = InTrade – Electoral College Prediction Markets = Probabilistic predictions for the 2008 US presidential elections based on market data from InTrade = electoralmarkets.com

–

– This is a dynamic chart, which is up to date. Click on the image, and open the website in another browser tab to get the bigger version.