–

–

Download this post to watch the video, if your feed reader does not show it to you.

Previously: The Interdependence of Prices and Gold –- by Jason Ruspini

UPDATE:

Jason:

I did not give $1500 as a gold target this year! When asked for my gold price prediction, I said, if you look at gold as a % of global fx reserves and investable assets you can justify very high gold price predictions, but I don’t like to model absolute levels, I like to look at marginal, incremental signals. If you put a gun to my head though: $1300-1350 — not “$1300-1500?.

Also edited out was a differentiation of liquidity shock vs. deflation vs. disinflation.

I should add that long-term trend-following is a fine way to trade gold.

These are all my own opinions, not those of Conquest.

I gave a talk on Thursday night at the New York Investing Club meeting.

The basic points:

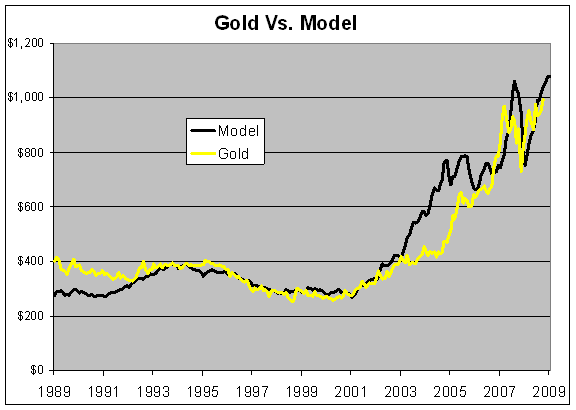

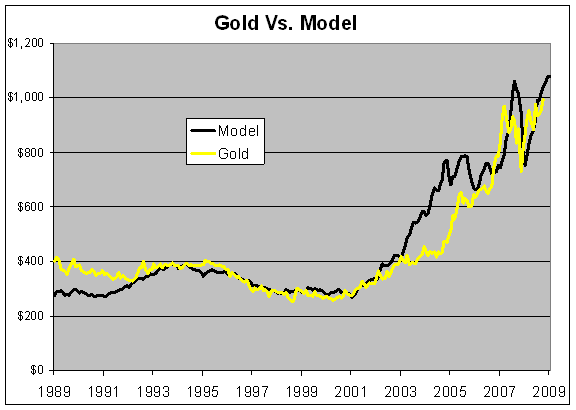

Gold does well when real rates of return are low. Real rates describe the price of gold much better than inflation alone. This is because real rates reflect the opportunity cost of holding a relatively useless asset. Part of the reason gold seems irrational is that this extrinsic pricing is unintuitive and largely unappreciated.

Gold does well when liquidity, measured for example by LIBOR, is not especially tight.

Sentiment can be predictive with gold.

The “-extrinsic”- way of thinking is natural in the fx world where all trades are two?sided, and the idealized one?sided currency , e.g. Dollar Index, is a weighted average of two?sided rates. Other examples: the Fed Model and Dividend Discount models explicitly tie together the pricing of equities and interest rates. The housing bubble was to some extent already a mispricing of money in the form of interest rates. What was the “right” price for housing given the price of money?

Do people who claim that assets exhibit “irrational” moves have a clear idea of what level of volatility would be “rational”, especially given such cross?influences? I do not endorse the Dividend Discount Model, but no-one can deny that it is a fundamental model, and it predicts higher volatility when rates are low. Given current levels, a 10% one day drop of the market is by no means absurd. The stock market should also have more idiosyncratic volatility when it is driven by “-top-down”- policy, rather than averaging many “-bottom-ups.”-

There is perhaps a “-long-termism”- fallacy. Even if prices change glacially, if you want to maintain a portfolio limited to 30 stocks out of a universe of 6000, it is easy to see how a sensible person might change the “-best ideas”- list with some frequency. The more prices change, the more frequent portfolio changes would be in order from a valuation standpoint. Again, asset prices are not hermetically sealed, one?sided meanings and values. There is always some discount factor or relative valuation at play.

The easiest way to achieve a shock “20 standard deviation” move is to just not mark (or mis?mark) for a while. Deferral of pricing is much more likely than active trading to originate an explosion large enough to affect the underlying economy. Deferral of pricing, not active trading, played a large role in the corporate credit crisis. Social Security and entitlement programs are also “off balance sheet” debt. At least banks failed to predict the future. Governments failed to predict the past. The basic demographic and longevity trend has been apparent since at least the 1960s.

Demographic trends suggest lower real returns than those seen in the 20th century. Do economists have a demographic blind spot?

![]()

Eddy Elfenbein’-s post ventures in the same territory as Jason Ruspini’-s one circa January 2010.

“-Not inflation”-, the gold critics will shout, in one of their go-to arguments. This is what we hear from CNBC’-s Mark Haines at every possible chance: since 1980, gold has not kept up with the CPI and so shouldn’-t be used as an inflation hedge. One would point out to Mark that this is analogous to arguing for global cooling based on that one 2005 start date. If you pick basically any other start date but the one corresponding to gold’-s 1980 peak, you see something different, even giving CPI a long head start over floating gold prices:

| Cumulative Increase Through December 2009 |  - | ||||

|  - | CPI | Gold | Gold/CPI Increase Ratio | ||

| From: |  - |  - |  - |  - |  - |

| Jan-55 | 808.3% | 3129.5% | 3.87 |  - |  - |

| Jan-70 | 476.9% | 3113.9% | 6.53 |  - |  - |

| Jan-75 | 320.1% | 514.8% | 1.61 |  - |  - |

| Jan-80 | 185.0% | 143.8% | 0.78 |  - |  - |

| Jan-85 | 105.4% | 254.2% | 2.41 |  - |  - |

| Jan-90 | 71.8% | 176.3% | 2.45 |  - |  - |

| Jan-95 | 44.5% | 197.8% | 4.44 |  - |  - |

| Jan-00 | 28.5% | 298.5% | 10.46 |  - |  - |

| Jan-05 | 13.3% | 155.6% | 11.74 |  - |  - |

But in shorter time-frames gold critics do have half a point. Since 2003, on a daily basis, gold returns have only been 12.5% correlated to changes in the inflation rate implied by 10-year TIPs. On a monthly basis, gold returns are 9% correlated to those of the TIPs spread.

We can look back further if we examine the the monthly performance of gold versus year-over-year changes in the CPI index. The CPI index for a given month is released in the subsequent month, so CPI monthly values are shifted forward in this study to correspond to the month of their release. The YoY change in CPI is further assumed to be the market’-s expectation of future inflation. All gold prices here are daily averages based on the London PM fix through December 1974, and Comex/CME spot thereafter.

Ignoring the fact that gold generally rose in this period, it doesn’-t do particularly well when inflation is elevated by this definition. A cut-off of 4% was used because it was the round number that most nearly bisected the 501 months in question, but the pattern holds-up when this parameter and other assumptions are varied:

| Monthly Gold Price Changes By Inflation Rate, Apr 1968 –- Dec 2009 | ||||||

|  - | Sum | Number of Months | Average |  - |  - | |

| Months where inflation: |  - |  - |  - |  - | ||

| >- 4% | 180.4% | 225 |  - | 0.80% |  - |  - |

| <-= 4% | 232.3% | 276 |  - | 0.84% |  - |  - |

So what does gold hedge against? Gold does well when real returns are low. You can’-t consider inflation without looking at prevailing rates and growth. The rates used below are the average of daily 10yr constant maturity rates (GS10) within a given month. As Larry David would say, “-pretty …- pretty good”-:

| Monthly Gold Price Changes By Real Rate, Apr 1968 –- Dec 2009 | ||||||

|  - | Sum | Number of Months | Average |  - |  - | |

| Months where real rate: |  - |  - |  - |  - | ||

| <- 3% | 414.0% | 268 |  - | 1.54% |  - |  - |

| >-= 3% | -1.3% | 233 |  - | -0.01% |  - |  - |

3% was used because it is again the round number that most nearly bisects the observations, but it can be varied without changing the essential result. There are also simple ways to define low real returns without a fixed parameter that show similar performance breakdowns with very different distributions of months. Now, these are retrospective studies, not trading systems, but obviously there is little chance that those returns were drawn from populations with the same mean.

It’-s surprising that thoughtful types like Nouriel Roubini and Martin Feldstein have questioned gold’-s inflation hedging, but didn’-t mention this point —- it seems glaring: people hold the relatively useless metal when real rates and opportunity cost are low. This simple point somehow never comes through in the noise surrounding gold: the glib Spam-sagacity vs. the Fall of The Republic, all the go-to arguments.

Clearly there are other factors that may throw the model off for long stretches of time. These may be false positives (e.g. non-dollar weakness) or false negatives (e.g. if gold is monetized to the point that it rises in deflation).

Putting aside the current weakness related to the Euro and elevating risk aversion, since I’-m expecting real rates to be on the low end compared to the late 20th century, my bias is still long gold. If yields should rise, especially if they are driven by vigilance, gold might make less sense.

[Cross-posted with minor changes from Seeking Alpha]

![]()

Doctor Gloom:

Jim Rodgers on gold: