On Wednesday, January 30, 2008, at 9:00 AM PST (12:00 PM EST- 5:00 PM GMT- 6:00 PM CET), dollar-thirsty Nigel Eccles (pictured above) will be introducing HubDub at DEMO 2008 (one of the best IT conferences, along with eTech, LeWeb, CES, etc.). The DEMO website will be live-streaming the presentation video.

My best wishes go to Nigel Eccles for his presentation. (Is there something to win, at that DEMO conference? Is it a startup contest? Is there a trophy to win, at the end?)

In my view, the launch of HubDub (both a news aggregator and a MSR-powered, play-money prediction exchange) is a milestone.

It’-s not the first time that a prediction exchange adds content to its offerings (they all do that, now, even in small ways), but it’-s the first time that:

- Quality content from the outside (that is, from professional media organizations, including news blogs) is systematically included into the exchange offerings-

- Pertinent associations between the prediction markets and the news stories are proposed. (On top of the news aggregation mechanism, people vote for the most relevant stories on each prediction market page, so as to help the other traders to be better informed on the topic at hand. And, when creating an event derivative, the manager is asked to jot down keywords, which will be used by the search engine to harness links related to that prediction market.)

The Midas Oracle readers remember that I have been bullish on HubDub since day one. (See my previous post: HubDub wil redefine the play-money exchange landscape.) Others are now following.

I’-m not alone, anymore, in thinking that prediction market pages should published the URLs of the related advanced indicators (i.e., primary sources of information).

Enterprise prediction market consultant Jed Christiansen (pictured above).

Internet usability expert Alex Kirtland (pictured above).

And, after a good discussion, others came in agreement with the no-brainer idea that more external links and more information can be good for the prediction markets. (Next obvious discoveries: The sky is blue- The sun rises from the East- Water is wet- War is bad- The Internet is world wide- The French fries are not fried in France- The French bread is not baked in France- etc. ![]() )

)

If you think of it, David Pennock (pictured above) is the man to hire to tackle the problematic of integrating news links/stories with prediction markets —-since he is a world-renowned expert in both microeconomics and search engine technology. We are on his turf, here. ![]() Hence, he should be the one leading us —-as opposed to us pulling him.

Hence, he should be the one leading us —-as opposed to us pulling him. ![]()

What should the humans do with the prediction markets? As Michael Giberson knows better than I do, probabilistic predictions are the offspring of the trading activities on the event derivative markets. At inception, BetFair and TradeSports didn’-t give the first fig about those probabilistic predictions, but today, the event derivative industry is being defined both by its betting side and its forecasting side.

And now we can see the main difference between the betting exchange approach and the prediction market approach: promoting (the trading of low-cost event derivatives) to bettors versus promoting (the generating of dynamic, objective probabilistic predictions) to people.

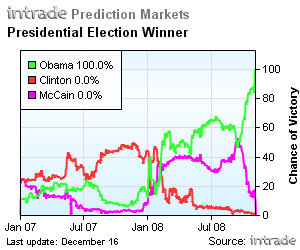

See, the prediction market approach consists in chasing people with news and probabilities. Hence, my personal version of HubDub would feature an aggregation news item (a la TechMeme, Memeorandum, or BallBug), mixed up with the appropriate InTrade/TradeSports/BetFair dynamic chart to give a hint on how the issue at hand will be settled in the near future. Content, first, and then the related prediction market chart —-as an informative appendix to a good scoop or quality analysis. The prediction market page would anti-chronologically list all the relevant news links.

And since the US (not Scotland) is the most fertile place for web search technologies, I bet that we will see soon some US-based HubDub-inspired startups popping up like champagne bubbles in the coming months and years.

Better Prediction Markets = A Better World

Read the previous blog posts by Chris. F. Masse:

- WHY THE PREDICTION MARKETS WILL LIKELY F**K UP SUPER TUESDAY 2008.

- Still unconvinced by prediction market journalist Justin Wolfers

- Oprah Winfrey

- RIGHT-CLICK THIS IMAGE, AND FILL IN THIS SURVEY, PLEASE.

- Papers on Prediction Markets

- The Journal of Prediction Markets

- The 45-degree Line