“-Does prediction market guru [= Chris Masse] understand probabilities?“-, asks our good friend Niall O’-Connor.

“-Does prediction market guru [= Chris Masse] understand probabilities?“-, asks our good friend Niall O’-Connor.

—-

—-

Let’-s ask economics PhD Michael Giberson:

Yes, I think you are right. I just looked at your exchange with Niall and Niall’-s post, and haven’-t thought through just how the over-round may affect things.

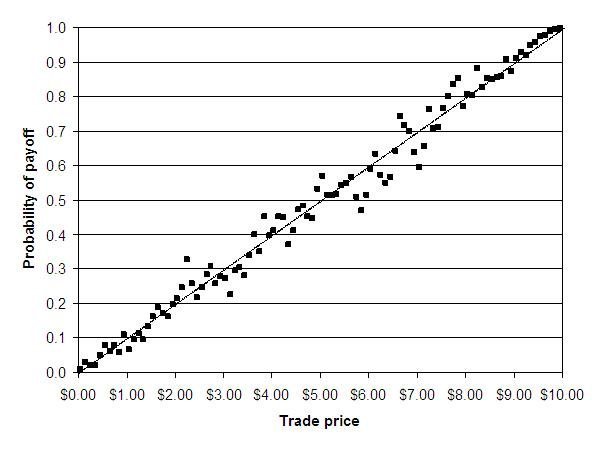

But it seems okay to do it just the way you say, because the digital odds implies a precise numerical prediction and that prediction can be stated in the form of a probability. Call the calculated number an implied probability of the event, and then you don’-t have to worry that a complete group of related market prices don’-t add to 100 percent.

If a trader believes that event X should be trading at 70 percent and sees current digital odds of 1.56 at Betfair ( =>- 64.1 percent), he should buy (considering fees, etc.). If the digital odds move to 1.4 ( =>- 71.4 ) then sell or at least don’-t buy.

Niall may be hung up on using a pure concept of probability. The purity is not useful- your explanation is useful. You win.

(Feel free to quote from this email, should you wish.)

-Mike

—-

UPDATE: Michael Giberson precises his comment…-

Niall, I agree that Professor Sauer’-s presentation explains how to estimate true probabilities from odds that do not sum to one. I was taking Chris Masse to be explaining a related, but slightly different task: the conversion of the digital odds that Betfair quotes to an implied probability.

The point of my slightly snide comment concerning purity reflects the pragmatic view that a trader could use the method Chris describes to convert from digital odds to an implied probability (which may be easier for some traders to think with and trade on). A single quote of digital odds implies a particular probability estimate. Chris’-s math gets the trader from the one number to the other. (=useful to traders)

To get to the estimate of true probabilities, as you have explained, a trader must have a complete set of odds for all possible outcomes for an event. This additional information requirement would completely stymie a trader wishing to arrive at the true probability estimates in cases in which some of the data is unavailable. (= not as useful to traders)

Read the previous blog posts by Chris. F. Masse:

- Pervez Musharraf prediction markets –Eric Zitzewitz Edition

- The Over-Round Explained

- WHY THE PREDICTION MARKETS WILL LIKELY F**K UP SUPER TUESDAY 2008.

- Still unconvinced by prediction market journalist Justin Wolfers

- Oprah Winfrey

- RIGHT-CLICK THIS IMAGE, AND FILL IN THIS SURVEY, PLEASE.

- Papers on Prediction Markets