SPOILER ALERT: MIDAS ORACLE IS REVEALING WHO DIES IN HARRY POTTER AND THE DEATHLY HALLOWS. IF YOU DON’-T WANT TO KNOW, STOP READING. (Hit your back button.)

SPOILER ALERT: MIDAS ORACLE IS REVEALING WHO DIES IN HARRY POTTER AND THE DEATHLY HALLOWS. IF YOU DON’-T WANT TO KNOW, STOP READING. (Hit your back button.)

—-

—-

Pioneer Press:

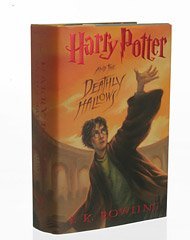

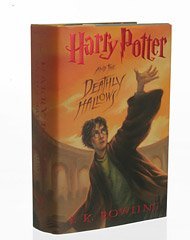

Here’-s the good news: Harry [Potter], Ron, Hermione, Ginny and Hagrid do not die. But others do. The good guys who meet their demise include Fred Weasley- Tonks (the witch who loves to change her hair color) and her husband, werewolf Remus Lupin- and Tonks’- father, Ted. Bad guys who die are Professor Snape- Bellatrix, Voldemort’-s favorite servant- Crabbe, one of Draco Malfoy’-s mean friends- and Pettigrew, Voldemort’-s servant known as Wormtail. One of the saddest scenes follows the death of Dobby, the house elf Harry [Potter] freed in a previous book. Harry [Potter]’-s beloved owl, Hedwig, also dies.

There is also an epilogue, which takes place 19 years later, revealing that Harry [Potter] married Ginny Weasley and Ron married Hermione. They meet at platform 9? to send their children to Hogwarts.

OK, but I would like more info about the epilogue. Does J.K. Rowling mentions that Harry Potter dies as a happy man at an old age? I think it’-s important because, since the statement of the Harry Potter event derivative is vague (”-alive”-), that could be a factor in the expiry of the NewsFutures contract. (As for me, no matter what is said in the epilogue about Harry Potter dying as an happy man at an old age, I believe that Harry Potter is still “-alive”- if J.K. Rowling will be able to write a sequel to her 7th book.)

—-

TEMPORARY CONCLUSION (until we get strong confirmation of the outcome of The Deathly Hallows from two other sources):

1. The NewsFutures event derivative was predictive (as was an Internet poll), thanks to comparative literature analysis (analysis of the past writings of J.K. Rowling).

2. The William Hill people were bull-shitting when they said that Harry Potter died and when they opened betting on who was the killer. They took 50,000 British pounds from suckers. 100% pure profit for William Hill. Niall O’-Connor, who swallowed the William Hill P.R. bullshit, should come on Midas Oracle, concede defeat, and analyze the root of his debacle.

—-

PREDICTION MARKET VS. BOOKMAKER: THE PREDICTION MARKET WON.

—-

© NewsFutures

—-

Static chart:

—-

THE NIALL O’-CONNOR FESTIVAL (1 + 2):

[1] What is the conclusion to be drawn here? In a market such as this, the outcome will already be known, by certain people. Are we too assume that these individuals choose to bet with traditional risk-averse bookmakers such as William Hill, forcing said bookmakers to close their books on the event? And that the uniformed, who know nothing, but cannot believe that Harry Potter will be killed off, choose to bet on NewsFutures?

[2] My own opinion is that the insiders have no reason to trade on NewsFutures (they are not interested in the notion of bragging rights). Moreover, it is extremely unlikely that they are even aware of the prediction exchange. They are interested however, in being able to take 500 sterling of William Hill, on a [fairly] anonymous basis. And this it would seem is what they have indeed done. The fact that the NewsFutures market has not fallen into line, gives rise to the notion that it represents nothing more than an amalgam of uninformed guessers, who are ignorant in the psychology of traditional betting markets. If Harry Potter is killed off- there will certainly be a lot of explaining to do……

Well, sounds like it’-s Niall O’-Connor who will have “-a lot of explaining to do”-.  …- And sounds like Niall O’-Connor is “-ignorant in the psychology”- of high-volume play-money prediction markets.

…- And sounds like Niall O’-Connor is “-ignorant in the psychology”- of high-volume play-money prediction markets.

—-

And Michael Giberson, too, should have some explaining to do.

—-

DISCLOSURE: At times, I was a participant in this Harry Potter prediction market, but decided to get out some time ago because of the incertitude regarding how the epilogue would be taken into account in the expiry process.

—-

NEXT: NEWSFUTURES JUDGES THAT HARRY POTTER IS STILL ALIVE AT THE END OF J.K. ROWLING’-S 7TH NOVEL, THE DEATHLY HALLOWS.

Previous blog posts by Chris F. Masse:

- Red Herring’s list of the top 100 North-American high-tech startups includes Inkling Markets —but not NewsFutures, Consensus Point, or Xpree.

- Professor Koleman Strumpf explains the prediction markets to the countryland people.

- Professor Koleman Strumpf tells CNN that a prediction market, by essence, can’t predict an upset.

- Time magazine interview the 2 BetFair-Tradefair co-founders, and not a single time do they pronounce the magic words, “prediction markets”.

- One Deep Throat told me that this VC firm might have been connected with the Irish prediction exchange, at inception.

- BetFair Rapid = BetFair’s standalone, local, PC-based, order-entry software for prediction markets

- Michael Moore tells the Democratic people to go Barack Obama in Pennsylvania (a two-tier state), but the polls and the prediction markets tell us that that won’t do the trick.

![]() Unless you’-re just just surfacing from an Afghan cave, you can easily guess who that “-David”- could be…-

Unless you’-re just just surfacing from an Afghan cave, you can easily guess who that “-David”- could be…- ![]()