Here are short excerpts of the Forrester report on enterprise prediction markets and companies that provide software for enterprise prediction markets (e.g., Consensus Point –-see the full list of providers at the bottom of this post).

–

The Forrester executive summary:

The “-wisdom of crowds”- is capturing the attention of corporate strategists across the globe, and, as a result, many are now looking to prediction markets — speculative markets in which traders collectively predict future events — to generate collective intelligence. For enterprises, prediction markets bring unique value: They focus on the future, aggregate diverse information pools that can be applied to multiple decision-making domains, create streams of actionable data suitable for executive decision-making, and can often cut through corporate politics and pressures at lower cost than traditional forecasting methods. Market researchers will, however, need to have an active hand in the management of these mechanisms, ensuring strong management support, the right incentives for traders, and a focus on appropriate questions. When executed properly, the value to the enterprise is enormous- as a result, Forrester believes that prediction markets will ultimately find a permanent home in the market research toolbox.

–

For information on hard-copy or electronic reprints, please contact the Client Resource Center at +1 866.367.7378, +1 617.617.5730, or resourcecenter –-at–- forrester –-dot–- com. We offer quantity discounts and special pricing for academic and nonprofit institutions.

–

–

–

My remark about the Forester report:

– It’-s a very good document.

–

APPENDIX #1: Prediction Markets – DRM Review

–

APPENDIX #2:

–

Here is a list of companies that provide software for prediction markets:

–

Inkling Markets – (MSR + AMM)

NewsFutures – (CDA + optional AMM + SR)

Consensus Point – (CDA + MSR + AMM)

Xpree – (MSR + AMM)

Zocalo – (CDA + MSR + AMM) – (open-source)

Nosco – (CDA + MSR + AMM)

QMarkets – (MSR + AMM)

Ask Markets – (MSR + AMM)

Exago Markets – (CDA + optional AMM)

Gexid – (?)

ProKons – (?)

Spigit – (?)

HSX Virtual Markets – (Virtual Specialist + AMM)

HubDub – (MSR + AMM) – (not licensed)

Yahoo!’-s Prediction Exchange – (MSR + AMM + DPMM) – (not licensed)

Google’-s Prediction Exchange – (CDA) – (not licensed)

MicroSoft PredictionPoint – (MSR + AMM) – (not licensed)

InTrade – (CDA + AMM for play money) – (not licensed)

TradeSports – (CDA + AMM for play money) – (not licensed)

Iowa Electronic Markets – (CDA) – (not licensed)

HedgeStreet – (CDA) – (not licensed)

TradeFair – (CDA) – (not licensed)

BetFair – (CDA) – (not licensed)

Trading Technologies International – (CDA) – (not for event derivatives)

–

Here’-s a list of prediction market consultants:

–

Robin Hanson – (George Mason University, Virginia, U.S.A.)

- Robin Hanson does prediction market consulting work, and have no exclusive arrangements.

- “-I’-m more interested in helping groups that want to add lots of value to big decisions, versus groups that just want to dabble in a new fad.”-

Inkling – URL: Inkling Markets – (Chicago, Illinois, U.S.A.)

NewsFutures – (Maryland, U.S.A. &- Paris, France, E.U.)

- Emile Servan-Schreiber — Post Archive at Midas Oracle

- Maurice Balick

Consensus Point – (Nashville, Tennessee, U.S.A. &- Calgary, Alberta, Canada)

- David Perry

- Ken Kittlitz, who co-founded the Foresight Exchange in 1994.

Xpree – (California, U.S.A.)

Chris Hibbert – (California, U.S.A.)

- Chris Hibbert (Software architect / Zocalo project manager) — Post Archive at Midas Oracle

- Chris Hibbert’-s personal website — Chris Hibbert’-s personal blog —

- Chris Hibbert’-s CommerceNet profile — (His stint there ended in mid 2006.)

Justin Wolfers – (University of Pennsylvania’-s Wharton Business School, Pennsylvania, U.S.A.)

- Justin Wolfers takes on prediction market consulting work.

- The prediction market industry is “-a case where the interaction between firm practice and academic research are reasonably close.”-

Koleman Strumpf – (University of Kansas, Kansas, U.S.A.)

- Koleman Strumpf — Post Archive at Midas Oracle

- Koleman Strumpf can be approached to consult on prediction market projects.

- “-Prediction markets help harness the knowledge of diverse groups. They have great potential as a tool for industry.”-

Nosco – (Danemark, E.U.)

- Jesper Krogstrup

- Oliver Bernhard Pedersen

Qmarkets – (Israel)

Ask Markets – (Greece, E.U.)

- George Tziralis — Post Archive at Midas Oracle

HP Services &- HP Labs – (U.S.A.)

- Predicting the future –-with games — Introductory article

- Information Dynamics Lab — Internal prediction markets

- BRAIN – (Behaviorallly Robust Aggregation of Information in Networks) — Scoring Rules (i.e., non-trading technique)

- Bernardo A. Huberman – Bernardo Huberman – Senior Fellow &- Director

- Kay-Yut Chen –

- Google Search for “-prediction markets”-

Hollywood Stock Exchange (HSX) &- HSX Research – (L.A., California, U.S.A.)

- Prediction market consultancy firm

- Movie business

IntelliMarket Systems – (L.A., California, U.S.A.)

- Charles R. Plott – Charles Plott – (CalTech Inst., California, U.S.A.)

Gexid – Global Exchange for Information Derivatives – (Germany, E.U.)

- Bernd Ankenbrand — Post Archive at Midas Oracle

ProKons – (Germany, E.U.)

Exago Markets – (Portugal, E.U.)

NimaniX – (Israel)

- Elad Amir (CEO), Littal Shemer Haim (VP Business development), David Shahar (VP R&-D)

Michael Giberson – (Texas, U.S.A.)

- Michael Giberson (Energy Economist – Center for Energy Commerce, Rawls College of Business, Texas Tech University) — Post archive at Midas Oracle

- Knowledge Problem – Blog on economics, energy policy, more.

Other Consulting Firms

McKinsey – (U.S.A.)

- Google Search for “-prediction markets”-

- The Promise Of Prediction Markets – by McKinsey – 2008-04-XX

Accenture – (U.S.A.)

- Google Search for “-prediction markets”-

Gartner – (U.S.A.)

- Google Search for “-prediction markets”-

Forrester – (U.S.A.)

- Google Search for “-prediction markets”-

- Prediction Markets: Wisdom Of The Crowd Comes To The Enterprise. – 2008-07-14

The Boston Consulting Group – (U.S.A.)

- Google Search for “-prediction markets”-

CapGemini – (U.S.A.)

- Google Search for “-prediction markets”-

KPMG – (U.S.A.)

- Google Search for “-prediction markets”-

Price Waterhouse Cooper – (U.S.A.)

- Google Search for “-prediction markets”-

Ernst &- Young – (U.S.A.)

- Google Search for “-prediction markets”-

Deloitte – (U.S.A.)

- Google Search for “-prediction markets”-

IBM – (U.S.A.)

- Google Search for “-prediction markets”-

EDS – (U.S.A.)

- Google Search for “-prediction markets”-

–

![]()

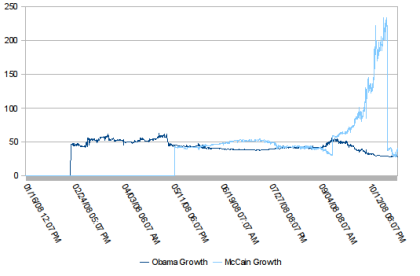

Here’-s an example using this morning’-s prices on NewsFutures. The histogram shows the results of 1 million simulated elections where each state goes red or blue according to its market-derived probability of doing so. Note how the “-most likely”- outcome, 364 votes for Obama – which is the number the “-leaning”- method would report – is at the same time very unlikely with just 5% chance of happening.

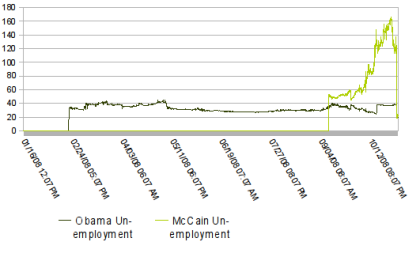

Here’-s an example using this morning’-s prices on NewsFutures. The histogram shows the results of 1 million simulated elections where each state goes red or blue according to its market-derived probability of doing so. Note how the “-most likely”- outcome, 364 votes for Obama – which is the number the “-leaning”- method would report – is at the same time very unlikely with just 5% chance of happening. How many people will watch Barack Obama’-s primetime address on 10/29?

How many people will watch Barack Obama’-s primetime address on 10/29?