![]()

–

Lawrence O’-Donnell (a leftist journalist –-but a good one, whom I appreciate):

A senior campaign official and Clinton confidante has told me that there will be a Democratic nominee by June 15. […] Yes, Clinton spokespersons publicly seem to be lost on gravity-free planet Clinton, but privately they know the end is near.

–

There’-s a quasi consensus among the political pundits to say that Hillary Clinton will not be the Democratic nominee in November 2008.

–

Tim Russert:

–

That was Wednesday night. I have just watched NBC Nightly News this Thursday, and the same Tim Russert appeared with 2 white boards full of calculations, which all pointed to Hillary Clinton being toasted.

–

My general thoughts about the place of the political prediction markets in this primary election season:

- The weight of the political prediction markets in the US political scenery is close to epsilon. I have been monitoring Memeorandum (the Web’-s best political news and opinion aggregator), and it has never featured one piece of political prediction market journalism —-not only that, but none of the popular popular pieces, featured by Memeorandum, has ever mentioned the political prediction markets and their probabilities. The people who breathe politics on a daily basis (the experts and the bloggers) don’-t give the first fig about the prediction markets. They couldn’-t care less.

- The prediction market luminaries who predicted that the prediction markets were to become a tool used in political campaigns were dead wrong. I have never read that campaign staffers use actively the political prediction markets. Campaigns use private polls, only.

- Like in 2004 (when Howard Dean was crowned, early on), the prediction markets, at the start of the primary season, were incapable of foreseeing who would be each party’-s nominee, ultimately —-Barack Obama and John McCain both came out of the blue. But the polls and the political experts didn’-t see them, too.

- Nothing surprising in that. While the idiots emphasize the supposed magical power of the prediction markets (using adjectives such as “-fascinating”- or “-intriguing”- when writing about them), the well informed people know for a fact that they simply aggregate information from the primary, advanced indicators and the opinions expressed by the political experts. Nothing more than that. The prediction markets are incapable of foretelling upsets, by essence.

- The last weeks were particularly interesting, in that regard, because the Obama-vs-Clinton polls have been of no interest —-only the views of the political experts who could count in terms of delegates and super-delegates were of interest. The political prediction markets on the Democratic side, these last weeks, have been a reflection of the pundits’- calculations.

- Outside of our blog, the only person who has aimed at practicing prediction market journalism is Justin Wolfers. He has understood the concept.

- I would have my own concept of prediction market journalism, and I don’-t agree with the way he executes, but that’-s a detail. The main thing is that he has gotten the concept. That’-s what is important, and that’-s what makes all the difference between Justin Wolfers and the HubDub bloggers (for instance). The concept. The concept. The concept. The idea is to center the narrative around the inputs given by the relevant prediction market(s) —-not just gluing artificially news bits and a prediction market chart (or a link to a prediction market).

- InTrade, BetFair and NewsFutures are, in my view, the 3 prediction exchanges that matter for prediction market journalism —-as of now.

–

Now, the charts of the expired prediction markets —-starting with Pennsylvania (of 2 weeks ago):

–

–

Yesterday’-s North Carolina:

–

Yesterday’-s Indiana:

–

Sources: InTrade &- BetFair

(Go there for the remaining primaries and caucuses. I don’-t put them on, here, because they don’-t matter anymore.)

–

Now, the charts of the prediction markets, going forward:

–

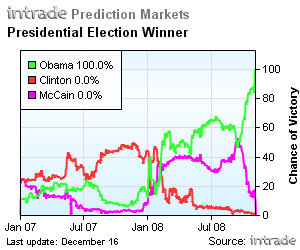

2008 US Presidential Election Winner – Individual

–

2008 US Presidential Elections

Source: Dynamic, compound prediction market charts from InTrade

–

Next US President

–

Winning Party

–

Female President?

–

Democratic Candidate

–

Republican Candidate

–

Source: BetFair Politics Zone

–

Barack Obama to win the Democratic nomination

© NewsFutures

–

Hillary Clinton to win the Democratic nomination

© NewsFutures

–

Next US President Will Be Democratic.

© NewsFutures

–

Next US President Will Be Republican.

© NewsFutures

–

Explainer On Prediction Markets

–

Prediction markets produce dynamic, objective probabilistic predictions on the outcomes of future events by aggregating disparate pieces of information that traders bring when they agree on prices. Prediction markets are meta forecasting tools that feed on the advanced indicators (i.e., the primary sources of information). Garbage in, garbage out…- Intelligence in, intelligence out…-

A prediction market is a market for a contract that yields payments based on the outcome of a partially uncertain future event, such as an election. A contract pays $100 only if candidate X wins the election, and $0 otherwise. When the market price of an X contract is $60, the prediction market believes that candidate X has a 60% chance of winning the election. The price of this event derivative can be interpreted as the objective probability of the future outcome (i.e., its most statistically accurate forecast). A 60% probability means that, in a series of events each with a 60% probability, then 6 times out of 10, the favored outcome will occur- and 4 times out of 10, the unfavored outcome will occur.

Each prediction exchange organizes its own set of real-money and/or play-money markets, using either a CDA or a MSR mechanism.

–

More Info:

– The Best Resources On Prediction Markets = The Best External Web Links + The Best Midas Oracle Posts

– Prediction Market Science

– The Midas Oracle Explainers On Prediction Markets

– All The Midas Oracle Explainers On Prediction Markets

–

Previous blog posts by Chris F. Masse:

- Prediction Markets

- Meet professor Justin Wolfers.

- Become “friend” with me on Google E-Mail so as to share feed items with me within Google Reader.

- Nigel Eccles’ flawed “vision” about HubDub shows that he hasn’t any.

- How does InTrade deal with insider trading?

- Modern Life

- “The Beacon” is an excellent blog published by The Independent Institute.

Yet.

Yet.