Latest update on the BetFair blog fiasco

—-

I am alerted today that the BetFair blog has updated its infamous Michigan story with a new compound chart bearing a clearer label. It reads now:

Republican nomination – The race so far

I’-ll have some comments, below the chart, but first a technical note. The new chart posted is a 527-KB BMP image. I have replaced it with a 32-KB JPG image. The BetFair blog is not run professionally. Any web publisher knows that images should be reduced to the max. That’-s the ABC of web publishing. (And to add insult to injury, I noted previously the technical bizarrery that the two professor Leighton Vaughan-Williams’-s stories never appeared in the BetFair blog feed.)

For you information, I have updated all my previous blog posts on the topic with an addendum re-publishing this new chart.

—-

UPDATED ANALYSIS OF THE BETFAIR BLOG FIASCO:

- Professor Leighton Vaughan-Williams should have defined what he means by “-betting markets”-, in his story. In the past (see the addendum of that story), prof Leighton Vaughan-Williams used two types of cocktail —-one including all betting markets (traditional bookmaker odds and exchange odds), one including only the BetFair odds. He should publish an addendum to his story defining exactly what he means by “-betting markets”-, this time.

- The BetFair blog editor should not have pasted a BetFair compound chart behind the writer’-s back. It’-s a big no-no in editing. Again, another proof (in a long list) that the Betfair blog is not run professionally.

- If a chart were to be inserted on top of LVW’-s story (with his consent, we hope), it should have been the expired chart(s) of the Michigan primary, since that’-s the heart of LVW’-s story.

- The fact that the BetFair blog editor pasted (behind LVW’-s back) a BetFair chart lead the readers (like Niall Or’-Connor and me) to conclude that professor Leighton Vaughan-Williams means “-the BetFair betting markets”- when he writes about “-the betting markets”-. This is probably not the case, but nobody knows for sure —-see my point #1 for the need of an explainer on this.

- Now, if professor Leighton Vaughan-Williams means “-the BetFair betting market”- (I assign a low probability on this scenario), then the story looks bad. The story is bullish on the fact that the Mitt Romney event derivative (for the Michigan primary) was predictive. The election-day chart that I published yesterday evening (and republished below) shows Mitt Romney being the favorite starting at 3:00 PM EST on election day…- Kind of a stretch to claim victory for the BetFair betting markets. I’-m still waiting for BetFair to send me the full, historical chart on the Michigan primary.

- BetFair should publish all expired charts —-just like InTrade-TradeSports are doing. See my new page, re-publishing some important expired prediction market charts. That way, any controversy could be settled more quickly.

- With all due respect to him, it looks bad on professor Leighton Vaughan-Williams for giving his writings to a corporate blog where the publisher and editor’-s names are not listed anywhere, and whose overall content quality is feeble —-to say the least. Especially since we read the testimony of a furious Betair blog writer, who described the BetFair blog editor as anonymous, incompetent and tyrannical.

- Besides Niall O’-Connor’-s critical comments, professor Leighton Vaughan-Williams’-s story on the BetFair blog has attracted a negative comment, calling his argument “-questionable to say the least“-, and asking (as I am doing on this current post) for more data to be published in an addendum.

- It looks bad on the BetFair management for publishing completely crappy stories like that. It damages the BetFair brand. I should tell my readers, though, that the BetFair-TradeFair managers (like Michel Robb, Tony Clare, Mark Davies, David Jack, Robin Marks, etc.) are highly professional, efficient, law-abiding, forward-looking, helpful, ethical, polite, and respectful. It is a real pity that the BetFair blog tarnishes BetFair’-s reputation.

- Betair should focus on being a prediction market resource for journalists and bloggers. As of today, they still don’-t provide on their website dynamic charts and expired charts.

- As I repeated many times on Midas Oracle, prediction market journalism is hard, complex and costly. It can’-t be done by any living organism (hermaphrodite or not

) simply equipped with a computer and an Internet connection.

) simply equipped with a computer and an Internet connection.

—-

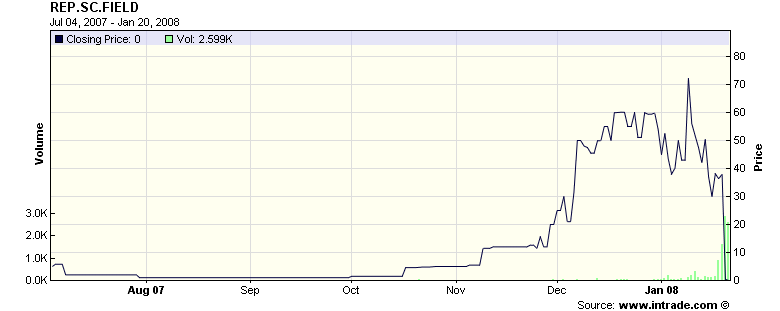

As an addendum, I re-publish here the election-day Michigan chart (on the Republican side). As I said, I’-m still waiting for BetFair to send me the full, historical chart. You can see, on this Republican-side chart, Mitt Romney (in red) as the Comeback Kid —-starting at 3:00PM EST on election day (that’-s 8:00 PM, British time, on the chart).

For your information, here’-s what professor Leighton Vaughan-Williams wrote. As I said, an explainer from him is needed to determine whether he means the “-betting markets”- in general (with, or without, BetFair included?) or the “-BetFair betting markets”-.

Professor Leighton Vaughan-Williams on the official BetFair blog:

[…] Those taking the same advice on Tuesday evening [2008-01-15 = date of the Michigan primary] were similarly well rewarded as well-backed Mitt Romney stormed into clear favouritism in the markets and a comfortable victory at the polls. After a blip in the New Hampshire Democratic primary the old certainties – that election favourites tend to win elections – was re-established.

As in the Republican New Hampshire primary, the polls and pundits had declared the race between Senator McCain and Governor Romney as a toss-up while the betting markets pointed to a comfortable victory in both cases for the eventual winners. Once again, in the battle of the polls, pundits and markets, the power of the betting markets to assimilate the collective knowledge and wisdom of the crowd had prevailed. […]

As for the InTrade “-betting markets”-, if that’-s what professor Leighton Vaughan-Williams means (solely, or among others), they show a strong support for Mitt Romney in the last 2 days (which includes election day). Kind of a stretch to claim a victory for the “-betting markets”-. Also, it would be funny to have the (anynomized) InTrade data interpreted on the blog of another exchange (BetFair, a competitor of InTrade-TradeSports) to hint about the alleged strength and accuracy of the BetFair “-betting markets”-. That would be the last drop that breaks the water bucket. Another reason why professor Leighton Vaughan-Williams should come forward to explain what he means by “-betting markets”- in his story. Does he mean the “-InTrade betting markets”-???

(FYI, the Mitt Romney event derivative was expired to 100.)

Psstt…- Sounds like a vertical line is lacking on this chart…- Look at the right end…- Bizarre.

—-

NEXT: No more anonymized trading data, please. State your source(s).

—-

![]()

![]()

2007-2008 NFC Championship —- Giants vs. Packers —- Source: TradeSports

2007-2008 NFC Championship —- Giants vs. Packers —- Source: TradeSports