![]()

The worst US economic recession in 50 years

Reply

![]()

![]()

![]()

Feed readers: Download this post to be able to watch this CBS 60 minutes video on the credit crisis.

–

Watch CBS Videos Online

![]()

– Text of Draft Proposal + NYT explainer

– Conrad Black’-s take on the financial meltdown

– Takes from 3 economists

– More links here. More links, again.

– UPDATE: Paul Krugman says the plan does not address the real problem.

– UPDATE: More Krugman

Some are saying that we should simply trust Mr. Paulson, because he’s a smart guy who knows what he’s doing. But that’s only half true: he is a smart guy, but what, exactly, in the experience of the past year and a half — a period during which Mr. Paulson repeatedly declared the financial crisis “contained,” and then offered a series of unsuccessful fixes — justifies the belief that he knows what he’s doing? He’s making it up as he goes along, just like the rest of us.

Exactly.

![]()

The most credible explanation of why risk management based on state-of-the-art statistical models can perform so poorly is that the underlying data used to estimate a model’s structure are drawn generally from both periods of euphoria and periods of fear, that is, from regimes with importantly different dynamics.

–

FOLLOW UP

–

![]()

Since Halloween, financial markets seem to be getting spooked again.

Larry Kudlow writes:

Until recently, I thought the Fed could stand pat at their December 11th meeting. However, I have completely changed my mind in light of the continuing credit market turbulence.

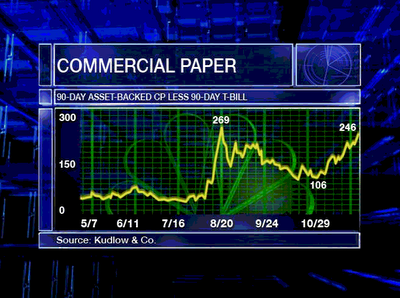

Kudlow notes that the spread between 30-day asset-backed commercial paper and U.S. Treasuries, which spiked up dramatically after August’-s liquidity events but subsequently eased back down, climbed back up during November to the neighborhood of its previous high.

|

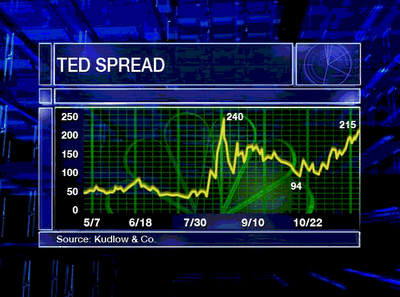

The same is true of the spread between the London interbank offered rate and Treasuries.

|

One of the features of the initial financial turmoil on which I commented last August is that it seemed to be confined specifically to the financing of problematic securities, but was not showing up as a broader risk premium in something like the spread between Baa-rated corporate bonds and 10-year Treasuries. But the latter spread has made a significant move up over the last month, and now stands 80 basis points higher than in July.

|

A sharp upward move in the Baa-Treasury spread is often associated with the early stages of an economic downturn, as the following longer-term perspective using monthly data illustrates:

|

For what it’-s worth, bettors at Intrade also seem to believe that the risk of a U.S. recession during 2008 has crept up since mid-October.

|

Cross-posted from Econbrowser.