Scroll down the whole story and judge by yourself, folks.

—-

New York Times:

“As he stated on Saturday, Senator Craig intends to resign on Sept. 30,” Mr. [Dan Whiting, a spokesman for Mr. Craig] said in a statement. “However, he is fighting these charges, and should he be cleared before then, he may, and I emphasize may, not resign.”

Aaaarrrrgh…-

Slate Video – Senator Craig: The Re-enactment

Sen. Larry Craig plead guilty to disorderly conduct following his arrest for allegedly soliciting in a public restroom. Slate V delivers a re-enactment, based on the police report.

Minnesota Police report.

Bathroom Sex FAQ

—-

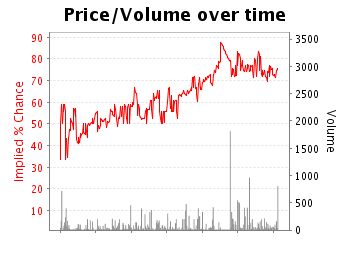

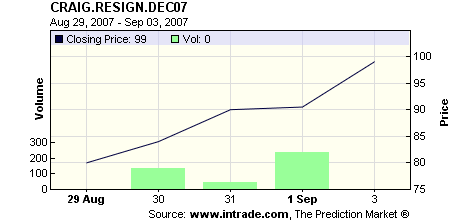

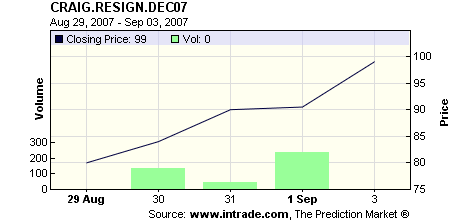

Yet another InTrade-TradeSports scandal??

—-

Sen. Larry Craig to announce resignation or intention not to run in 2008 on/before 31 Dec 2007 – This event derivative has been expired by InTrade.

The rules (= the event derivative contract statement):

This contract will settle (expire) at 100 ($10.00) if Senator Larry Craig announces his resignation from the Senate or announces he will not run for re-election in 2008 on or before 11:59:59pm ET on the date specified in the contract.

The contract will settle (expire) at 0 ($0.00) if this does not happen on or before 11:59:59pm ET on the date specified in the contract.

A resignation does not have to result in the actual departure by the contract expiry date but rather the announcement of the resignation must be made before the date and time specified in the contract.

Expiry will be based on official, public announcements made by Larry Craig as reported by three independent and reliable media sources.

Due to the nature of this contract please also see Contract Rule 1.7 Unforeseen Circumstances.

The Exchange reserves the right to invoke Contract Rule 1.8 (Time Protection) if deemed appropriate.

Any changes to the result after the contract has expired will not be taken into account – Exchange Rule 1.4

Please contact the exchange by emailing [email protected] if you have any questions regarding this contract before you place a trade.

Important:

Please contact the Exchange if you have any query or uncertainty (including how it may be settled) about this Contract, the Rule above or the Contract Rules before you trade.

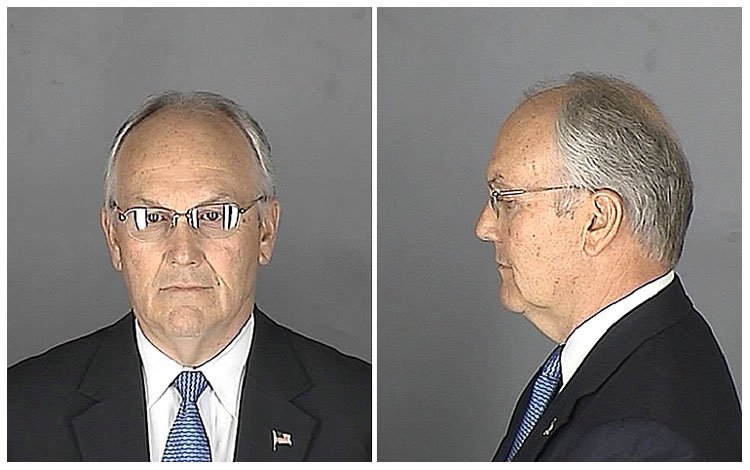

US Senator Larry Craig (on September 1, 2007 ):

Senator Craig Announces Intent to Resign from the Senate

BOISE, Idaho – Senator Craig made the following statement to Idaho:

First and foremost this morning, let me thank my family for being with me. We’-re missing a son who’-s working in McCall, and simply couldn’-t make it down. But for my wife Suzanne and our daughter Shae, and Mike to be with me is very humbling.

To have the governor standing behind me, as he always has, is a tremendous strength for me. To have Bill Sali who has never wavered, and who has been there by phone call and by prayer, and his wife, is tremendously humbling.

For the leader of our party, Kirk Sullivan, to be standing here, who sought immediate counsel with me in this, is humbling. For Tom Luna—for any public official at this moment in time—to be standing with Larry Craig is a humbling experience. Learn more about Senator Craig’-s top accomplishments

For most of my adult life, I had the privilege of serving the people of Idaho. I’-m grateful for the opportunity they have given me. It has been a blessing. I am proud of my record and accomplishments, and equally proud of the wonderful and talented people with whom I have had the honor and the privilege to work and to serve.

I choose to serve because I love Idaho. What is best for Idaho has always been the focus of my efforts, and it is no different today. To Idahoans I represent, to my staff, my Senate colleagues, but most importantly, to my wife and my family, I apologize for what I have caused. I am deeply sorry.

I have little control over what people choose to believe, but clearly my name is important to me and my family is so very important also. Having said that, to pursue my legal options, as I continue to serve Idaho, would be an unwanted and unfair distraction of my job and for my Senate colleagues. These are serious times of war and of conflict—times that deserve the Senate’-s and the full nation’-s attention.

There are many challenges facing Idaho that I am currently involved in. And the people of Idaho deserve a senator who can devote 100 percent of his time and effort to the critical issues of our state and of our nation.

Therefore it is with sadness and deep regret that I announce that it is my intent to resign from the Senate, effective September 30. In doing so, I hope to allow a smooth and orderly transition of my loyal staff and for the person appointed to take my place at William E. Borah’-s desk. I have full confidence that Governor Otter will appoint a successor who will serve Idaho with distinction.

I apologize to the people of our great state for being unable to serve out a term to which I have been elected. Few people have had the privilege and the pleasure to represent Idaho for as many years as I have. Each day, each week, each year brought new challenges and opportunities to create a better life for Idahoans. I have enjoyed every moment and cannot adequately put into words how much I appreciate what you have given me: the chance to work for this great state. I hope you do not regret the confidence you have placed in me over all of these years. I hope I have served you and our state to the best of my ability.

Lastly, Suzanne and I have been humbled beyond words by the tremendous outpouring of support we have received from our friends, our family, our staff and fellow Idahoans. We are profoundly and forever grateful. Thank you all very much.

US Senator Larry Craig announced his intent to resign, not his upcoming resignation (or effective resignation). Big difference. A resignation intent is not an upcoming/effective resignation. We know now, thanks to the New York Times, that there was an unstated conditionality —-whether Larry Craig gets cleared before the 30th of September 2007. Thus, InTrade should not have expired the Larry Craig event derivative on the basis of that senatorial output. I bet that some traders will soon complain on the Intrade-TradeSports forum. They can contact me, if they wish.

More Info: – AP – MSNBC Video – Idaho Stateman –

—-

ADDENDUM:

Definitions of the word “-intent”- on the Web:

* purpose: an anticipated outcome that is intended or that guides your planned actions– “-his intent was to provide a new translation”– “-good intentions are not enough”– “-it was created with the conscious aim of answering immediate needs”– “-he made no secret of his designs”-

* the intended meaning of a communication

* captive: giving or marked by complete attention to- “-that engrossed look or rapt delight”– “-then wrapped in dreams”– “-so intent on this fantastic…-narrative that she hardly stirred”– Walter de la Mare- “-rapt with wonde

r”– “-wrapped in thought”-

wordnet.princeton.edu/perl/webwn

* Intent in law is the planning and desire to perform an act.

en.wikipedia.org/wiki/Intent

* Reiki is an Intent driven system. Intent is the key to using the Reiki energy in healing and Attunements.

www.reikithehealingpath.com/reiki_glossary.htm

* Intent is the plan and will to act in a particular way or choice to remain inactive.

www.attorneykennugent.com/library/i.html

* The singlemost causal agency in all action, creation, destruction and change at all levels of existence. That component of consciousness which gives rise to all forms. The means by which the Will of God and Natural Law is manifest. The essence and source of motivation.

www.eoni.com/~visionquest/library/glossary.html

* Humans appear to be comprised of two important awarenesses: The Conscious Awareness (usually experienced through the personality) and a Greater Awareness. The Greater Awareness resides at body center and is connected to a fundamental force Seers call Intent. Intent is the equivalent of a muscle in the physical world. It is the means by which action, change, and expression happen in both the physical and energetic worlds for all humans. …-

sentecenter.com/glossary.htm

* the mood, message, or meaning desired by the artist

www.learner.org/channel/workshops/artsineveryclassroom/p1popups/vocabulary.html

* A state of mind (mens rea) in which a person seeks a particular result through a particular course of action.

www.iejs.com/glossary/Glossary_I.htm

* the subtextual objective of a character

www.austin.cc.tx.us/sbramme2/Glossary.htm

* Voluntary function of a person’s mind in purposely performing a perceivable act.

www5.aaos.org/oko/vb/online_pubs/professional_liability/glossary.cfm

* requires that one intended to deprive the possessor “-permanently”- of the property. Although the mens rea of larceny is the intent to steal, the focus is on the loss to the possessor, not the gain to the defendant. Thus, even if the thief did not gain in the taking, if the possessor lost in the process. Courts have also held that permanence can be more than keeping forever. …-

www.voyager.in/Larceny

—-

PARTING SHOT:

The problem with most of the socially valuable prediction markets (i.e., the non-sports prediction markets) is that all depends on:

– how well the event derivative contract is stated-

– how well the related information is interpreted-

– how well the event derivative contract is expired.

With the Larry Craig prediction market, we have yet another example that InTrade (which gets plenty of cites in Midas Oracle * and other business media outlets) might not have done its job with the highest degree of professionalism required —-at least in my opinion. Judge by yourself, scanning all the facts presented above by yourself.

In the summer 2006, I denounced the North Korean Missile scandal, and here’-s what followed:

– I received an e-mail from InTrade CEO John Delaney saying that I could put a prize of $10,000 in the ‘-lost’- column-

– I have been attacked by a second-tier phone-booth conference organizer, sponsored by InTrade-

– I received e-mailed insults from Ireland, sent on forged e-mail accounts.

—-

[*] 3,820 cites of InTrade, says Google Search.

—-

Next: Resignation Intent vs. Upcoming Resignation vs. Effective Resignation

—-

UPDATE: Chris Masse’-s response to the Mike Giberson comment…-

The real issue is not much that InTrade makes a mistake (we all do), but whether it acknowledges its mistake and compensates the victims. (In the North Korea Missile scandal, InTrade did not behave well in this perspective, according to my reading of the situation.) […]

US Senator Larry Craig simply said, “I’m thinking about resigning on September 30”. He did not say, “I’m resigning, effective September 30.” There is a huge difference between the two kinds of statement. And this difference (and InTrade’s error) pops up today because Larry Craig is exercising his constitutional right to change his intent. […]

Next: Donald Rumsfeld’-s resignation letter – November 6, 2006

—-

UPDATE: New York Times…-

Sen. Larry Craig has all but dropped any notion of trying to complete his term, and is focused on helping Idaho send a new senator to Washington within a few weeks, his top spokesman said Thursday. ”-The most likely scenario, by far, is that by October there will be a new senator from Idaho,”- Craig spokesman Dan Whiting told the Associated Press. The only circumstances in which Craig might try to complete his term, Whiting said, would require a prompt overturning of his conviction for disorderly conduct in a men’-s room at the Minneapolis airport, as well as Senate GOP leaders’- agreement to restore Craig’-s committee leaderships posts taken away this week. Those scenarios are unlikely, Whiting said.

Craig, a three-term Republican, met Wednesday with Idaho Gov. C.L. ”-Butch”- Otter, R, to discuss a transition in which Otter would name his Senate replacement, Whiting said. Even if Craig were to complete his term, he said, the senator would not seek re-election in 2008. Whiting said Craig remains intent on clearing his name through the legal process in Minnesota and by having the Senate ethics committee address his claim that his misdemeanor conviction should not be a matter for action by the panel. […]

UPDATE: How US Senator Larry Craig managed to fool InTrade-TradeSports.

—-

UPDATE: InTrade-TradeSports should have expired the Larry Craig event derivative today, on October 4, 2007, and not on September 5, 2007.

InTrade-TradeSports should have expired the Larry Craig event derivative today, on October 4, 2007, and not on September 5, 2007. That’-s their main error. Last September, they expired this event derivative on the basis on Larry Craig stating his “-intent to resign”- —-which is different than to announce an upcoming or effective resignation. Larry Craig later changed his “-intent”- —-he then intended to stay in the US Senate (providing he would be able to withdraw his guilty plea). Unfortunately, today, a judge ruled against his attempt to dismiss his guilty plea. So, US Senator Larry Craig is announcing today that:

- He is not resigning from the US Senate-

- He will not seek re-election for his US Senate seat.

The condition #2 is sufficient to expire the December 2007 Larry Craig contract on the “-yes”- side. (”-Yes”-, he is announcing his “-intention not to run in 2008″-.)

—-

UPDATE: Craig hopes to redeem himself for future lucrative job as lobbyist.

![]()