![]()

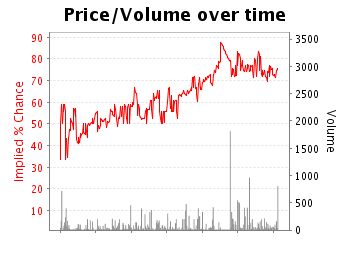

What will be the change in US Federal Funds Rate at this month’-s scheduled Federal Open Market Committee (FOMC) meeting?

FOMC – September FOMC

Current Rate 5.25% .

– 0.25

UPDATE: BetFair accurately predicted the direction of the interest rate change, but was too shy in its prediction of the amplitude of the interest rate change.

BetFair predicted: -0,25

The Fed decided: -0.50

That’-s for the absolute accuracy. Now, what counts is the relative accuracy —-the comparison between the prediction made by BetFair and the predictions made by the financial markets experts. I see that the rate cut of 50bp has come up as a big surprise to the Wall Street pundits. For example, here’-s what Felix Salmon wrote this morning, before the Fed’-s meeting taking place in the afternoon:

But my gut feeling is that Bernanke should announce a nominal 25bp cut in the Fed funds rate to 5% (hell, it averaged 5% in August anyway) along with a more substantial 50bp or even 75bp cut in the discount rate.

An interesting comparison would be Felix Salmon vs. BetFair over the next 10 years. I bet that BetFair will beat Felix Salmon and the other Wall Street pundits, over the long term.

—-

The Federal Reserve’-s statement:

Release Date: September 18, 2007

For immediate releaseThe Federal Open Market Committee decided today to lower its target for the federal funds rate 50 basis points to 4-3/4 percent.

Economic growth was moderate during the first half of the year, but the tightening of credit conditions has the potential to intensify the housing correction and to restrain economic growth more generally. Today’s action is intended to help forestall some of the adverse effects on the broader economy that might otherwise arise from the disruptions in financial markets and to promote moderate growth over time.

Readings on core inflation have improved modestly this year. However, the Committee judges that some inflation risks remain, and it will continue to monitor inflation developments carefully.

Developments in financial markets since the Committee’s last regular meeting have increased the uncertainty surrounding the economic outlook. The Committee will continue to assess the effects of these and other developments on economic prospects and will act as needed to foster price stability and sustainable economic growth.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman- Timothy F. Geithner, Vice Chairman- Charles L. Evans- Thomas M. Hoenig- Donald L. Kohn- Randall S. Kroszner- Frederic S. Mishkin- William Poole- Eric Rosengren- and Kevin M. Warsh.

In a related action, the Board of Governors unanimously approved a 50-basis-point decrease in the discount rate to 5-1/4 percent. In taking this action, the Board approved the requests submitted by the Boards of Directors of the Federal Reserve Banks of Boston, New York, Cleveland, St. Louis, Minneapolis, Kansas City, and San Francisco.

UPDATE:

BetFair predicted: -0,25

The Fed decided: -0.50

And, now, how did the economists fare? (Bloomberg link via Niall O’-Connor of Betting market, who has a comment.)

It was the first time in almost five years that the Fed move differed from analysts’- predictions. The half-point reduction in the federal funds target was forecast by 23 of 134 economists surveyed by Bloomberg News. One hundred and five predicted a reduction of 25 basis points, while six forecast no change. A basis point is one-hundredth of a percentage point.

– BetFair’-s probabilistic prediction: -0.25 @ 73%

– Bloomberg’-s probabilistic prediction: -0.25 @ 78%

So, BetFair’-s probabilistic prediction was close to Bloomberg’-s one. Neither better, nor worse.

Ooops – Wrong.

“The US Federal Reserve cut interest rates by 50 basis points on Tuesday, in an aggressive move designed to head off the risk of a sharp slowdown in economic growth that could culminate in recession.

The deeper-than-expected cut to 4.75 per cent followed weeks of turmoil in financial markets and mounting investor concern over the economic fallout from problems arising from the US subprime mortgage industry.”

Amazing – inflationary pressures remain with crude at almost record levels, and they feel able to cut this much…no wonder the markets are looking so surprised. This is one big bad gamble…