![]()

Google CEO Eric Schmidt at Bloomberg on the Future of Technology

Reply

![]()

![]()

![]()

I’-d say no, but I could be damn wrong.

Where is Tom W. Bell when we need him?

![]()

Look at the quote at the bottom of this webpage.

UPDATE: They have just brought the Best Buy quote down. ![]()

![]()

Toward Info Accounting In Competitive Forecasting – PPT file – by Robin Hanson – 2008-10-15

An interesting set of slides —-though it’-s about the technicalities of value assessment, and not about the big picture.

![]()

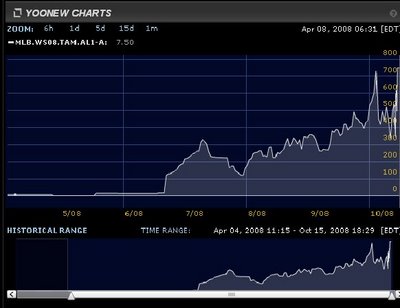

No one epitomizes the success you can have on the yoonew exchange like the Tampa Bay Rays. The Rays, were a ball club who finished in last place last season in the AL East for the 3rd straight year. Playing in the same division with the World Champion Red Sox and former dynasty New York Yankees always provided prognosticators an easy pre-season prediction for the Rays: last place. The outlook was never rosy for the Rays despite their young talent because of the financial disparity between them and the teams who held court at the top of their division.

Entering this season, Las Vegas sportsbooks had the Rays as a 200-1 futures bet to win the World Series. Seven months later, the Rays are now in the World Series and bettors who even invested $10.00 in them can walk away with a cool $2000.00. Vegas sportsbook’-s will be in for a cold winter if the Rays manage to pull off a World Series victory against the Phillies and possibly become the greatest baseball story of all-time. There’-s already been talk out of Vegas that they’-ll never open a team at those odds again.

But, on the yoonew exchange it was a totally different story. yoonew.com is the “-Stock Market for Sports Tickets.”- A futures site where fans can get tickets for the big events like the Super Bowl, Stanley Cup, NBA Finals, World Series, UEFA Finals, Final Four, and BCS National Title at prices much lower than face value. On yoonew, you can also buy a “-Team Fantasy Seat”- or “-Matchup Fantasy Seat”- on a team and as they progress in the season, the initial value of your futures stock could increase and you can either sell it for a profit, hold on to them hoping it continues increasing, or hope your team makes it to the big game to receive your free ticket.

The initial IPO for Rays 2008 World Series ticket futures was $7.50 before the season started. When yoonew began making markets for the team in June when they looked like a real threat, there were asks at 18.50. Looking back, It was a steal for anyone on the exchange. Plenty of traders appeared to be saying: “-Why not the Rays?”- They had nowhere to go but “-UP,”- especially with the excessive amounts of young talent they had entering the season and the early season struggles of the Sox and Yanks.

Before we delve deeper into explaining the meteoric rise of the Rays, let’-s take a month by month look at the Rays and how yoonew users who bought this season were happy to hold on to them.

Take a look at the chart below and the month by month breakdown which was originally analyzed on yoonewverse.com:

Month by month Rays breakdown:

March Pre-Season (Market launch):$7.50

April: $7.50 (14-12 record)

May: $15.00 (33-22 record)

June: $217.07 (49-33 record)

July: $161.68 (62-45 record)

August: $342.44 (83-52 record)

September: $394.10 (97-65 record)

Up 3-1 on the Red Sox: $1050.00

Up 3-2 on the Red Sox: $750.00

Tied 3-3 with the Red Sox: $650.00

Clinch ALCS Title: $750.00

There are obviously two sides to every trade and it won’-t always be as profitable as the Rays. For example, take the story that Bigleaguestew.com wrote on yoonew and the Chicago Cubs market and how it completely dropped from nearly $4000.00 to a stunning $2.00.

Plenty of yoonew users invested in the Rays in mid-May when the Rays swept the Los Angeles Angels and then won 3 out of 4 against the same team who beat up on them for years, the Yankees, in a division battle that sent a clear message: “-We are here to stay.”- As the season progressed, the Rays continued to make believers out of their doubters. On the season, the biggest increase the Rays made month to month was from May to June when they increased +134% on the exchange.

As the summer ended and the Fall classic was weeks away, fans and sports futures traders began registering on the site and buying the Rays as an investment they felt was profitable. Rays fans also saw the potential World Series berth waiting in the wings and got in on them as well. Plenty of traders cashed out with their $300 and $400.00 in profit. You even had die-hard Rays fans who cashed out because of the need for extra cash in these down economic times and said they’-d take their chances with the Rays on sale for tickets.

Now, flash forward past the division title, home-field advantage, and ALCS title, the Rays are now in the World Series playing the Phillies for the ultimate prize. Of course, there were other yoonew users from across the country who bought in early and kept their tickets for the World Series at prices in the $50’-s and $100’-s while a ticket on the open market cost above $300.00 at this point in time. A huge savings for them and the yoonew mission was complete – which is to give fans a chance to land tickets under face value to the hard to get games.

By: Claudio E. Cabrera

![]()

Judith Miller.

Yes, the infamous Judith Miller.

![]()

The NYT writers discusses 2 (different?) issues.

–

#1. There was market arbitrage opportunies in the recent past between InTrade and BetFair —-unlike 4 years ago, and contrary to the laws of economics.

– The price of the Barack Obama event derivative was cheaper on InTrade than on BetFair and the Iowa Electronic Markets. Conversely, the price of the John McCain event derivative was more expensive on InTrade than on BetFair and the Iowa Electronic Markets.

–

–

#2. The NYT writer reports (without linking to it) the findings of the InTrade investigation about the behavior of their unnamed “-institutional investor”-.

– InTrade CEO John Delaney suggests that that institutional investor:

– Justin Wolfers’- PHD student remarks that that institutional investor is not making an effort to shop around for the best prices, within each InTrade political prediction market.

–

RELATED: See the comments on Midas Oracle here, here, here, and here.

–

![]()

I agree with that.

The key, now, is to go beyond the accuracy issue and to move on to the utility issue.

It’-s a much complex problematic, which those who have been over-selling the prediction markets are unwilling to undertake. [*]

Maybe a small bunch of prediction market people, maybe assembled in a new prediction market structure, might go for that lofty goal of fingering the specific instances where prediction markets create real social utility.

–

[*] Yelling across the harbor, like an illuminated Jesus Christ, that prediction markets can help “-avoiding future [financial] crisis”- is a sign that some prediction market practitioners have lost their intellectual compass. To my knowledge, InTrade hadn’-t had any prediction market focused on the “-looming credit crunch crisis”-, last summer. Its CEO should be careful about making any grand statement. As I wrote many times, at best, the prediction markets are the best umpire you can have between either the mass media and the politicians, on one hand, and a group consisting of the best experts, on the other hand. An umpire is only useful during critical times, in a game. But, other than that, most of the times, the umpire is not the determinant of the game —-the players are.

The researchers and practitioners should make a solid case for each of these critical instances where the prediction markets have a real social utility.

Stop the over-selling. Let’-s start the real work.

–

![]()

How can you assess the impact of Colin Powell’-s endorsement of Barack Obama? You can’-t.

![]()

Intrade has made a statement on the unusual trading that many have noted and alleged to be manipulative. The statement suggests that the price action is mostly attributable to a single firm, a hedger “-using our markets in good faith and in the ordinary course of their business.”-

The first company that comes to mind is Centrist Messenger. Centrist is an interesting firm that re-sells political ad time and refunds sales to customers whose candidate loses. Centrist has stated publicly that it uses Intrade to hedge this exposure.* If Centrist had something to do with the unusual trading, it suggests that they sold more Obama than McCain ads, creating exposure to a GOP victory, resulting in McCain buys and Obama sales on Intrade. Why such a firm would be such urgent price-takers isn’-t fully explained.

Whether or not it was Centrist isn’-t important, but as these markets mature we should expect them to attract more hedging activity, and this might introduce persistent price distortions. Indeed it makes sense for people in the top tax bracket to be long Obama apart from considerations of his chances of victory. This is another uncomfortable subject that I’-ve warned about in the past. When these markets become deeper and more widely available, the odds of the high-tax candidates might begin to show an upwards bias, a risk premium. Interestingly, Musto and Yilmaz predict that such markets will eventually lead to increased promises of redistribution by candidates. Talk about unintended consequences.

Intrade is doing the right thing here though, dealing with tough issues realistically and with as much transparency as possible. They provide valuable information, for free, even in places where they are not necessarily welcome. The depth of this information helps us to evaluate Intrade prices and have more confidence in them. Here is an example below, based on Obama’-s market over the past two weeks. Some have noted that the purported attacks occurred in hours where the market was unusually thin. This chart measures such price manipulability. The red line represents the ease of a downwards attack. It is the 100 x the amount of margin required to sweep the top fifteen bids divided by the difference between the highest bid and the fifteenth highest bid. (That is, how much the probability of an Obama victory can be moved by risking $100. Commissions are not taken into account but would of course would be vital.) The green line is the ease of an upwards attack. This is a very preliminary study and I will leave it to others to voice initial impressions. The fact that we can gauge to what extent traders are exercising market power is in itself important and encouraging however.

* Technically another firm does the trading. Centrist is incorporated in the US, and the trading firm is incorporated in St. Kitts. Through this arrangement, Centrist cleverly avoids violating UIGEA.

[Cross-posted from Risk Markets and Politics ]