![]()

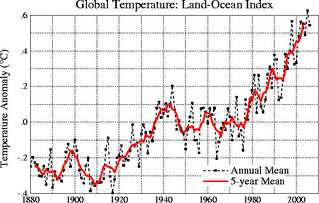

How about a contract series as follows, based on NASA’-s Goddard Institute for Space Studies global temperature (C) data for surface air temperature change, using 1950-81 as baseline:

GISS.2007.ANNUAL.MEAN<-.50

GISS.2007.ANNUAL.MEAN>-.50

GISS.2007.ANNUAL.MEAN>-.60

GISS.2007.ANNUAL.MEAN>-.70

The data series can be found here. Some pretty graphs here.

Cross posted from CaveatBettor.

What would be the time period? Which advanced indicators would the human market makers used in order to stay on top?

And do you think that real-money prediction markets would work on that one?

I’ll bet the farm on GISS.2005.ANNUAL.MEAN>.60

Did you mean 2007?

But this isn’t really global warming, it’s just seasonal (annual) prediction.

“But this isn’t really global warming”

Which would show-up at the margin, the annual numbers. If you try to make the contract more significant (longer-term), I think the fear is that you’ll dilute liquidity. Also, longer-term contracts might trade in a way logically approximating that of a one-year contract, but with less volatility. Exchanges like Intrade and Hedgestreet instead tend to maximize contract volatility.

“But this isn’t really global warming”

Would a series of contracts be global warming?

I’d prefer to go for a longer-term average than a bunch of annual ones (eg GISS.2010-2020.AV > 0.6). Or the trend over the next 20-30 years (like my bet).

James Annan’s bet:

For more links, see:

http://www.midasoracle.org/200…..as-oracle/

I appreciate all the comments thus far. Whether or not the numbers indicate global warming, they seem less controversial and disputable as far as the sourcing and methodology is concerned.

As you can see from the graph, it is moving higher, so there is some warming trend, however infintesimal. My personal hypotheses on warming aside, I believe listing well-formed contracts on a hot-button issue will further our progress in predictive markets.

As far as longer term averages go, they will probably eat up a lot of margin for a longer term, too. This will disincent traders from taking and holding significant positions.

“predictive markets”

Caveat Bettor: I have “predictive markets” as much as I hate “information markets”. In both cases, it’s not a good marker.

NOAA admits a human role in global warming.

http://www.econbrowser.com/arc….._of_k.html