![]()

Below is a copy of a post yesterday on my personal blog. First, a couple asides for Midas Oracle readers.

After 2008

Two of Peter McCluskey’-s four sets of contracts produced interesting results while all of Polimetrics’- were duds. (Not complaining- I’-ll take the successes.) What should we take from this, other than a subsidy being helpful? (How helpful?)

It would be nice to see improved versions of the two successful sets offered for 2012 and perhaps for control of the US Congress in 2010. The Iraq contracts could be generalized to expected number of troops killed, number of troops abroad, or even size of the military budget.

It would be great to see conditional contracts for non-US jurisdictions as well.

On Intrade’-s part, I’-d really, really like to see implied outcomes and graphs of same built into the Intrade interface. Their lack is a huge barrier to understanding conditional contracts, both for journalists and bloggers who might come to appreciate their importance, and even for traders who need to understand them, even really smart traders.

Futarchy Lite?

Futarchy imagines that constituents or their representatives specify (presumably democratically) desired outcomes and prediction markets evaluate whether specific policies further desired outcomes, neatly captured in the phrase vote on values, bet on beliefs. One could imagine a variety of implementations, in particular concerning how policies are proposed, but that’-s the basic framework.

So what does the guide have to do with futarchy?

It encourages voters to govern their own vote as a policy making body would govern policies. Presumably individuals have values or can decide on them, so there’-s no voting, but one can use prediction markets to determine how they should vote in order to further their values. So the catchphrase for the futarchist voter guide below or what I’-ll call “-Futarchy Lite”- is vote with your values, consensus beliefs. Ok, that’-s not at all catchy. And I’-m afraid to too many people interpret values and beliefs to be roughly the same, but that’-s a bigger problem.

Mike’-s Futarchist Voter Guide (also posted on Mike’-s blog)

Four years ago I used play money contracts traded at the Foresight Exchange to provide a Futarchist Voter Guide (though I didn’-t call it that). This U.S. election cycle relevant real money contracts are traded on Intrade.

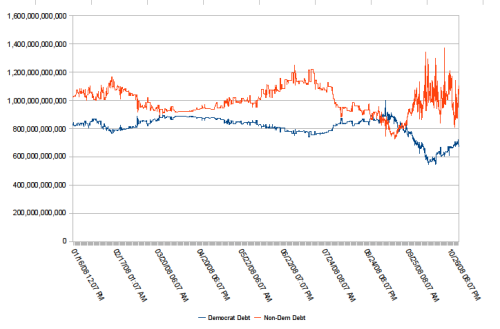

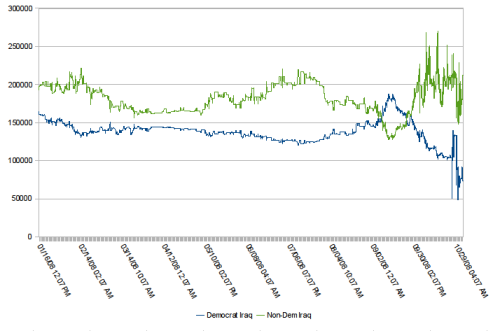

The first set was instigated and subsidized by Peter McCluskey. Two have attracted a fair amount of interest and seem to be informative. They have consistently indicated that a Democrat will result in a smaller (but still approaching US$1 trillion!) increase in the US federal government debt over one year and a smaller number of US troops in Iraq. (The others, regarding the movement of oil and interest rate futures on election day, have shown no difference between expected election outcomes.)

Above: Expected increase in US Government debt between 30 Sep 2010 and 30 Sep 2011 if party wins US presidency.

Above: Number of US troops in Iraq on 30 June 2010 if party wins US presidency.

Note that briefly in early September the contracts indicate lower debt and fewer troops in Iraq with a Republican candidate. I suspect this is due to McCain’-s brief surge following the GOP convention —- the implied outcomes above depend on election winner contracts, and with a much lower volume, presumably take awhile to fully respond to rapid shifts in election outcome expectations.

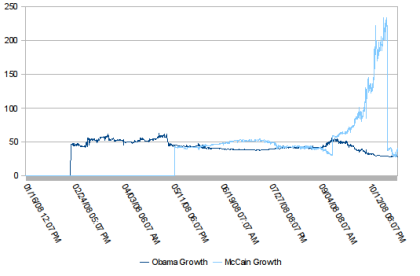

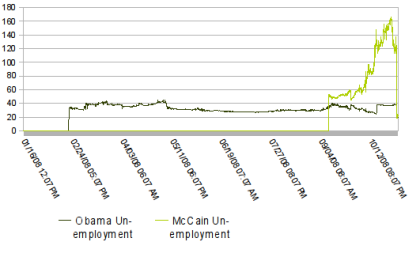

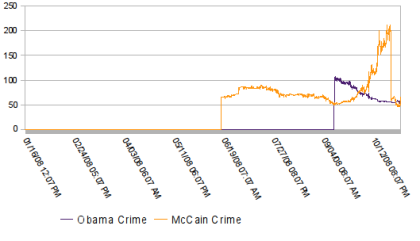

A second set of relevant contracts instigated by Polimetrics have unfortunately attracted almost no trading and probably tell us nothing. Note however they also reflect the brief McCain surge, at which point they implied a greater than 100% chance of growth, low unemployment, and lower crime with a McCain win. They have since reverted to showing essentially no difference between Obama and McCain. Note that each series only starts when there have been trades.

Above: Percent chance that economic growth averages 2.5% or more for 2009-2011 if individual wins US presidency.

Above: Percent chance the US unemployment rate is less than 5.0% at the end of 2011 if individual wins US presidency.

Above: Percent chance the number of violent crimes committed in 2010 is lower than the number of violent crimes committed in 2007 if individual wins US presidency.

Peter McCluskey has automatically updated pages showing implied outcomes for each set of contracts given their latest trades.

(I intended to make a page with frequently updating graphs, but got lazy when Peter published the aforementioned pages, and only collected the data until now, which is available in a spreadsheet.)

[…] Addendum 20081103: See a slightly expanded version of this post at Midas Oracle. […]

I’m unwilling to trust these prices. Some simple reasons (I’ll post a more careful analysis on my blog within a week):

NONDEM.PRES-GOVT.DEBT and NONDEM.PRES-TROOPS.IRAQ prices have often implied they would be expired above 100 if the Republican wins, when the rules say the maximum expiration value is 100.

The implied values show large moves with the Democrat and Republican implied prices going in opposite directions. This appears to indicate market inefficiencies that are large compared to the implied differences between the Democrat and Republican implied results. The financial news over the past two months ought to have caused the implied debt increase to rise in ways independent of the election result, but I see no such effect in the graphs you present.

I very much look forward to your careful analysis.

It isn’t completely obvious to me that recent financial news should cause the implied debt increase to increase over the period the contract concerns — between 30 Sep 2010 and 30 Sep 2011.