![]()

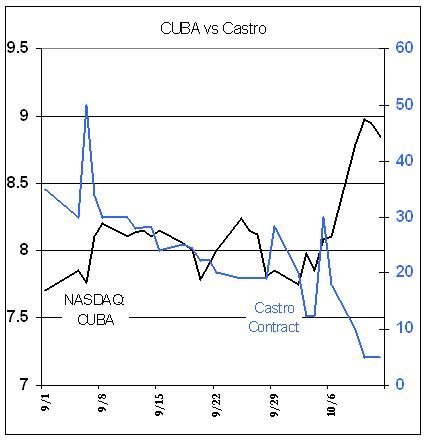

Traders can benefit from buying CUBA, a small closed end fund, and treating it like a call option on the death of Fidel Castro. The relationship between the TS contract and the price of the fund can be seen on the chart. More details here: Profiting from the Cuban Market

Investing in a Cuban fund that has zero holdings in Cuba? This seems to be a case of getting correlation and causation confused.

Top 10 holdings as of June 2006:

Florida East Coast Industries, Inc. 18.73%

Consolidated Water Co. 8.57%

Watsco Incorporated 6.62%

Seaboard Corporation 6.61%

Florida Rock Industries, Inc. 6.08%

Royal Caribbean Cruises Ltd. 4.80%

Carnival Corp. 4.31%

Garmin Ltd. 4.28%

Orthofix International N.V. 3.00%

Banco Latinoamericano de Exportaciones 2.53%

This analysis is suspect.

The US bans investments in Cuba, so the fund isn’t able to make any direct investments in that market (they do hold some speculative defaulted bonds.) Instead the fund is positioned to profit when sanctions are eventually lifted, which is why the holdings show a lot of shipping and tourism firms. The fund is not a pure Cuba play, but recently it had been trading like it is.

There is little doubt that Fidel Castro is out of power and will not return. The interesting question is whether his successors will change anything, and nobody outside of the Cuban leadership knows the answer to this question. The discussion of the fund at International Investing assumes that change of leadership = change of policy, and while this may be an accurate assumption it is not necessarily so.