![]()

You should read:

– Philadelphia’-s baseball team (the Phillies) won the World Series —-and it happens that prediction market expert Justin Wolfers also lives and works in Philadelphia, PA.

–

TradeSports:

–

HubDub:

–

![]()

You should read:

– Philadelphia’-s baseball team (the Phillies) won the World Series —-and it happens that prediction market expert Justin Wolfers also lives and works in Philadelphia, PA.

–

TradeSports:

–

HubDub:

–

![]()

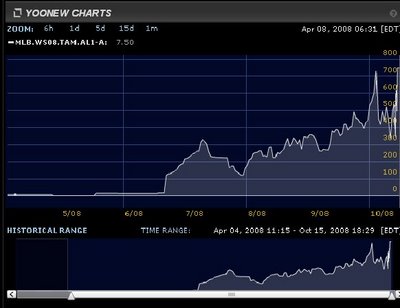

No one epitomizes the success you can have on the yoonew exchange like the Tampa Bay Rays. The Rays, were a ball club who finished in last place last season in the AL East for the 3rd straight year. Playing in the same division with the World Champion Red Sox and former dynasty New York Yankees always provided prognosticators an easy pre-season prediction for the Rays: last place. The outlook was never rosy for the Rays despite their young talent because of the financial disparity between them and the teams who held court at the top of their division.

Entering this season, Las Vegas sportsbooks had the Rays as a 200-1 futures bet to win the World Series. Seven months later, the Rays are now in the World Series and bettors who even invested $10.00 in them can walk away with a cool $2000.00. Vegas sportsbook’-s will be in for a cold winter if the Rays manage to pull off a World Series victory against the Phillies and possibly become the greatest baseball story of all-time. There’-s already been talk out of Vegas that they’-ll never open a team at those odds again.

But, on the yoonew exchange it was a totally different story. yoonew.com is the “-Stock Market for Sports Tickets.”- A futures site where fans can get tickets for the big events like the Super Bowl, Stanley Cup, NBA Finals, World Series, UEFA Finals, Final Four, and BCS National Title at prices much lower than face value. On yoonew, you can also buy a “-Team Fantasy Seat”- or “-Matchup Fantasy Seat”- on a team and as they progress in the season, the initial value of your futures stock could increase and you can either sell it for a profit, hold on to them hoping it continues increasing, or hope your team makes it to the big game to receive your free ticket.

The initial IPO for Rays 2008 World Series ticket futures was $7.50 before the season started. When yoonew began making markets for the team in June when they looked like a real threat, there were asks at 18.50. Looking back, It was a steal for anyone on the exchange. Plenty of traders appeared to be saying: “-Why not the Rays?”- They had nowhere to go but “-UP,”- especially with the excessive amounts of young talent they had entering the season and the early season struggles of the Sox and Yanks.

Before we delve deeper into explaining the meteoric rise of the Rays, let’-s take a month by month look at the Rays and how yoonew users who bought this season were happy to hold on to them.

Take a look at the chart below and the month by month breakdown which was originally analyzed on yoonewverse.com:

Month by month Rays breakdown:

March Pre-Season (Market launch):$7.50

April: $7.50 (14-12 record)

May: $15.00 (33-22 record)

June: $217.07 (49-33 record)

July: $161.68 (62-45 record)

August: $342.44 (83-52 record)

September: $394.10 (97-65 record)

Up 3-1 on the Red Sox: $1050.00

Up 3-2 on the Red Sox: $750.00

Tied 3-3 with the Red Sox: $650.00

Clinch ALCS Title: $750.00

There are obviously two sides to every trade and it won’-t always be as profitable as the Rays. For example, take the story that Bigleaguestew.com wrote on yoonew and the Chicago Cubs market and how it completely dropped from nearly $4000.00 to a stunning $2.00.

Plenty of yoonew users invested in the Rays in mid-May when the Rays swept the Los Angeles Angels and then won 3 out of 4 against the same team who beat up on them for years, the Yankees, in a division battle that sent a clear message: “-We are here to stay.”- As the season progressed, the Rays continued to make believers out of their doubters. On the season, the biggest increase the Rays made month to month was from May to June when they increased +134% on the exchange.

As the summer ended and the Fall classic was weeks away, fans and sports futures traders began registering on the site and buying the Rays as an investment they felt was profitable. Rays fans also saw the potential World Series berth waiting in the wings and got in on them as well. Plenty of traders cashed out with their $300 and $400.00 in profit. You even had die-hard Rays fans who cashed out because of the need for extra cash in these down economic times and said they’-d take their chances with the Rays on sale for tickets.

Now, flash forward past the division title, home-field advantage, and ALCS title, the Rays are now in the World Series playing the Phillies for the ultimate prize. Of course, there were other yoonew users from across the country who bought in early and kept their tickets for the World Series at prices in the $50’-s and $100’-s while a ticket on the open market cost above $300.00 at this point in time. A huge savings for them and the yoonew mission was complete – which is to give fans a chance to land tickets under face value to the hard to get games.

By: Claudio E. Cabrera

![]()

How can you assess the impact of Colin Powell’-s endorsement of Barack Obama? You can’-t.

![]()

Alex Tabarrok writes that “-someone was manipulating Intrade to boost John McCain’-s stock price”-.

No…-!!!…-

John Delaney said that that firm has been hedging on InTrade —-a normal and beneficial activity on the other (larger and more liquid) financial markets.

InTrade is not liquid enough to weather (quickly enough) the impact made by the hedging activities, at this time, but will in the future, if growth continues.

Manipulation is bad.

Hedging is good.

![]()

Florida went blue around 8:51 PM, on September 26, 2008…- for a brief period of time:

–

The Democratic side:

–

Tip via Lance Fortnow

–

Previously:Is InTrade being manipulated?

–

UPDATE: See Jason Ruspini’-s expert analysis in the comment area.

–

![]()

A good enough (although atrociously elliptic) implementation is provided by Wall Street wiz (and ex convict) Henry Blodget.

Many modules are missing, but it’-s good enough. Henry Blodget made an effort on data visualization —-something Justin Wolfers never did.

![]()

CNBC video + CNBC video #2

The second CNBC video segment that TradeSports-InTrade CEO John Delaney does not want you to see on YouTube:

–

Nate Silver mentioned a Poker player. Why?

Our previous post on the InTrade micro-manipulations

–

![]()

– New York Times

– Another one bites the dust:

(Sorry for those who have a narrow screen and don’-t see the right part of this big chart.)

–

According to InTrade, here are the banks that could fail next:

– Bank United Financial

– Downey Financial

–

External Links About The Big Bailout:

– Reason magazine have collected opinions from the leading free-market economists on the Bailout issue.

There is no reason to expect the correct solution from the same people who created the crisis in the first place and who until very recently thought the economy was strong and that there was little or no chance of recession. [Mark Thornton]

This is a financial coup d’-etat, with the only limitation the $700 billion balance sheet figure. [Yves Smith]

– Mike Linksvayer has some additional good links…- and some strong words, too. ![]()

– Arnold Kling:

– NYT:

–

UPDATE: Paul Krugman

–

UPDATE: The Manhattan Institute on financial crisis and the Bailout

–

UPDATE:

![]()

I am not surprised at all by the results.

Maybe a non-profit organization should sponsor PunditWatch.

Robin Hanson (mister “-Track Records”-), take notice.

![]()

[Cross-posted from our twin blog, Midas Oracle .COM]

–

$125 million —-and that’-s only on the first day of the auctions.

Felix Salmon has an omelette on his head, now.

–

UPDATE: NYT – The Times of London – BBC News